Sustainability-focused solutions: two goals

Responsible investing is a spectrum—and there are no universally accepted classifications. The spectrum and definitions will continue to evolve as new solutions and innovations enter the investment industry. Currently, we have classified established investment approaches into the categories below. Along the spectrum, sustainability-focused solutions intersect where the goals overlap—they are designed to deliver competitive returns while also making a positive societal and/or environmental impact in the world.

| Investment approach | Screening | ESG integration | Sustainability-focused | Impact-first | Philanthropy |

|---|---|---|---|---|---|

Definition |

Actively eliminate or select investments according to specific ethical values | Mitigate risky ESG practices in order to protect value | Address specific societal challenges that generate competitive returns | Measure progress against specific environmental and social goals | Measure progress against specific environmental and social goals without striving for returns |

Primary objective is delivering competitive returns |

|||||

| Goal of social and/or environmental impact |

Benefits of sustainability-focused investing

Sustainability-focused solutions

We are committed to broadening our sustainability-focused offering, starting with Sun Life KBI Sustainable Infrastructure1.

About Sun Life KBI Sustainable Infrastructure

This solution is designed to capitalize on the growing opportunities in listed sustainable infrastructure, globally focused on three key areas:

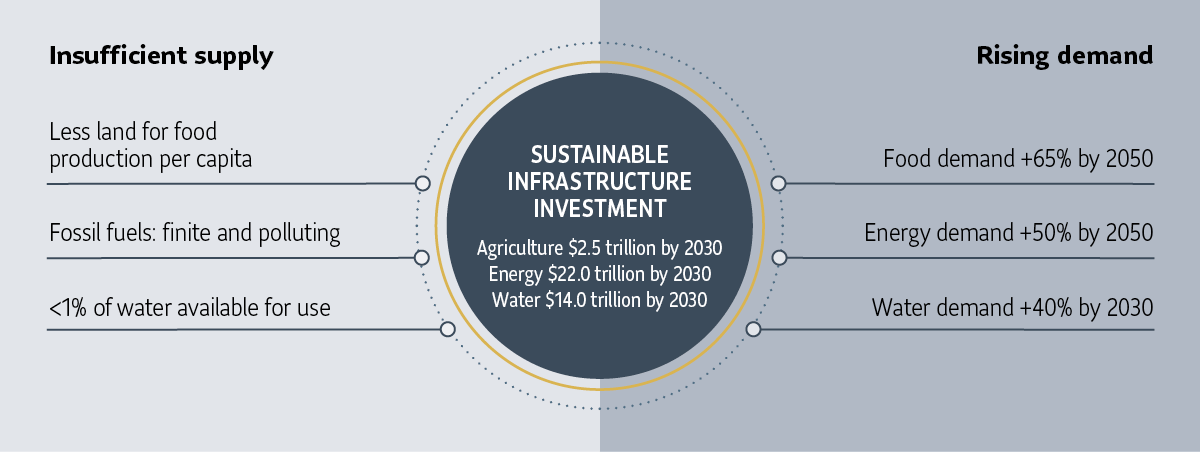

Driven by insufficient supply and rising demand, these opportunities represent a potential US$38.5 trillion of investment in these three areas.

Source for infographic: Food Demand: Michigan State University, “feeding the world in 2050 and beyond”, 2018. Water Demand: Global Institute, November 2011: “Water and Power Infrastructure”. Energy Demand: US Energy Information Administration, 2019. Power and Water required investment: Brooking Institute, “Delivering on Sustainable Infrastructure”, 2016. Agribusiness required investment: FAO, “The Future of Food and Agriculture, Trends and Challenges, 2017: Land for Farming.“

Meet the manager: KBI Global Investors2

Video: CIO Discusses Sun Life KBI Sustainable Infrastructure

Noel O'Halloran, Director-Chief Investment Officer, KBI Global Investors, discusses the opportunity in sustainable infrastructure, and the advantages of Sun Life KBI Sustainable Infrastructure.

1 Sun Life KBI Sustainable Infrastructure Segregated Fund is a segregated fund offered by Sun Life Assurance Company of Canada through its Group Retirement Services platform; it invests directly in series I units of the Sun Life KBI Sustainable Infrastructure Private Pool, a mutual fund managed by SLGI Asset Management Inc. Series I securities are only available to certain mutual funds and eligible institutional investors. Commissions and trailing commissions are not payable on Series I securities but management fees and expenses may be associated with these investments. Each Series I investor negotiates its own management and advisory fee that is paid directly to SLGI Asset Management Inc. Please read the prospectus before investing.

2 KBI Global Investors (North America) Ltd. is sub-advisor to Sun Life KBI Sustainable Infrastructure Private Pool and is part of the KBI Global Investors Ltd. Group.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.