The U.S. Federal Reserve hiked its policy rate by 75 basis points (bps) during its policy meet on June 15 to lift the benchmark federal-funds rate to a range of 1.5% and 1.75%. In doing so, the central bank veered off script from its earlier guidance of gradually hiking interest rates by 50 bps through the summer of 2022. The 75-bps point hike in interest rates is the largest single hike since 1994.

The fight isn’t just against inflation, but also against expectations

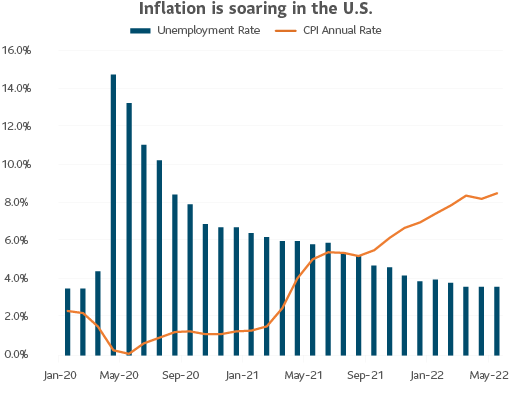

The Fed had good reasons to diverge from its earlier guidance. When the May CPI print came in at 8.6%, a 40-year high, it quickly became clear to both the markets and the Fed that assumptions about peak inflation was off the mark. Additionally, University of Michigan Consumer Survey reported that respondents expected prices to advance 3.3% over the next five to 10 years, the most since 2008. Such data raised fears that inflation expectations could get unanchored and complicate the fight against price gains.

Fed revises down growth and unemployment projections

In taking the interest rate to more restrictive territory to fight inflation, the Fed seemed to acknowledge a slowdown ahead. Fed projections now show U.S. GDP growth at around 1.7% for this year and next, from its March projection of 2.8% in 2022 and 2.2% in 2023. In addition, the median forecast for unemployment is expected to rise to 3.7% by 2022 and 4.1% in 2024 from the current 3.6% in May. These projections come at a time of rising uncertainty in U.S. equity markets that are already suffering a sharp downturn.

All eyes on Canada

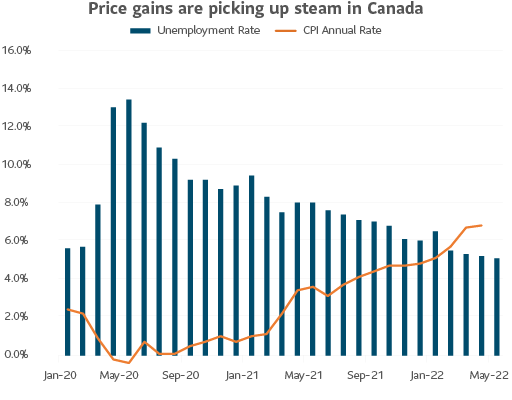

Canada’s inflation and labor market pressures are not unlike that of the U.S.’s. Canada’s jobless rate of 5.1% is the lowest going back to the year 1976 and its inflation rate of 6.8% is the highest since 1991, bolstering the case for a 75-bps hike. As of mid-June, overnight swap markets were suggesting an 80% chance that the Bank of Canada could hike interest rates by 75 bps for a policy rate of 2.25%.

Our view

Last Friday’s surprisingly sticky inflation report, along with the Fed’s aggressive response to the data print has meaningfully increased recession risks in our view. Specifically, it appears that policy makers will be laser focussed on tightening until inflation data, which is lagging in nature, has shown a sustained cooling trend while paying less attention to softening leading indicators of economic activity. We are continuing to increase defensive positioning within the Granite portfolios while navigating the highly volatile environment.

Disclosure

This article contains information in summary form for your convenience, published SLGI Asset Management Inc. Although this article has been prepared from sources believed to be reliable, SLGI Asset Management Inc. cannot guarantee its accuracy or completeness and is intended to provide you with general information and should not be construed as providing specific individual financial, investment, tax, or legal advice. The views expressed are those of the author and not necessarily the opinions of SLGI Asset Management Inc. Please note, any future or forward looking statements contained in this article are speculative in nature and cannot be relied upon. There is no guarantee that these events will occur or in the manner speculated. Please speak with your professional advisors before acting on any information contained in this article.