Highlights

- With the exception of Canada’s, major equity markets fell into correction territory before rebounding at quarter-end

- More than 150,000 Russian troops invaded Ukraine

- U.S. Federal Reserve and Bank of Canada raised key interest rates 0.25%, with the bond market pricing in multiple hikes to come

- Oil prices surged to a high of US$123.70 a barrel on war-related supply concerns

- Yield on bellwether U.S. 10-year Treasuries climbed from 1.51% to 2.3%

- Canadian dollar rose slightly to US$0.80

Rising inflation and surging yields

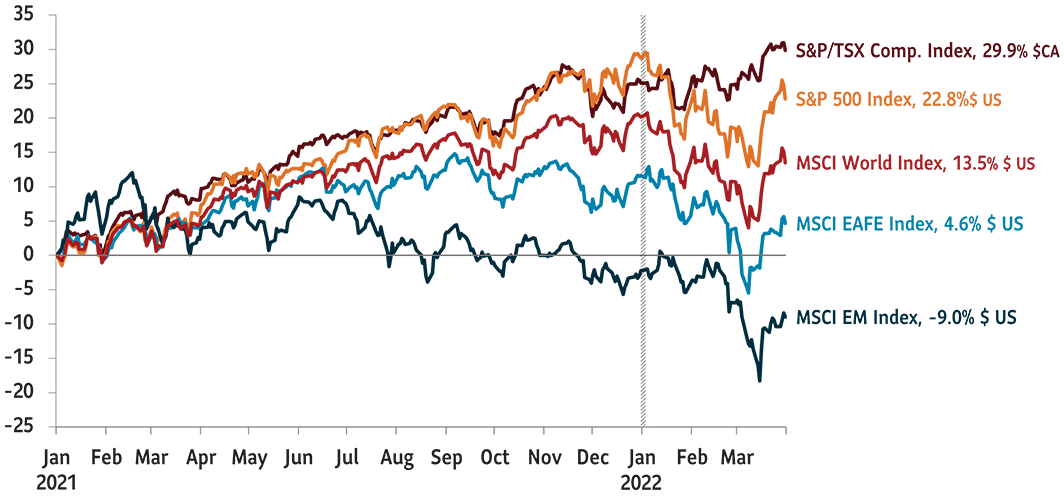

The new year started on a bullish note, with the S&P 500 hitting a record high. But looking ahead investor concerns turned to inflation running at 7.9% in the U.S. – a 40-year high. With inflation surging, the U.S. Federal Reserve, which could no longer argue that it was transitory, hiked its key interest rate by 0.25%, with the market pricing in as many as seven rate hikes by the end of 2022. And then Russia invaded Ukraine, igniting the first full-scale war in Europe in over 70 years. Together: war, inflation and the threat of higher interest rates drove investors to the sidelines, with the S&P 500 down 11.6% and the tech-heavy Nasdaq off 18% in the first week of March. But, as they have since the market lifted off the pandemic bottom in March 2022, investors appeared to believe the selling was overdone and again rushed in to buy the dip, with the S&P 500 rebounding strongly at quarter-end (Chart 1).

But whether the rally into quarter-end was a dead-cat bounce in a still downward trending market remains to be seen. Certainly, a tsunami of negative issues still overhangs the market. For one, interest rates are rising around the world, with over 16 central banks, including the Bank of Canada and the Fed, hiking rates. As monetary policy tightens, fiscal stimulus, including the US$3 trillion that was injected into the U.S. economy in 2021, is beginning to wane.

Furthermore, the unprecedented economic sanctions placed on Russia following its invasion of the Ukraine could slow the global economy and erode corporate earnings, which may have already peaked. And with the war triggering a surge in the price of oil and other commodities, it raised the possibility that stagflation (slow growth, high inflation) may return after a 40-year absence. Finally, there is COVID-19. While control measures have slowly been lifted in North America and Europe, China continues to lockdown major parts of its economy – in the process further stressing supply chains and possibly cutting into domestic and global growth.

Neutral, with a tilt toward high-quality growth

Against this wall of worry, we remained broadly neutral in the Sun Life Granite Managed Solutions in Q1. However, the market correction in Q1 gave us an opportunity to increase our weighting in U.S. high-quality growth stocks, resulting in a 2.2% overweight exposure to U.S. equities.

Graph 1: Major markets

Total return, indexed to 0 as of January 1, 2021

Source: Bloomberg. Data as of March 31, 2022.

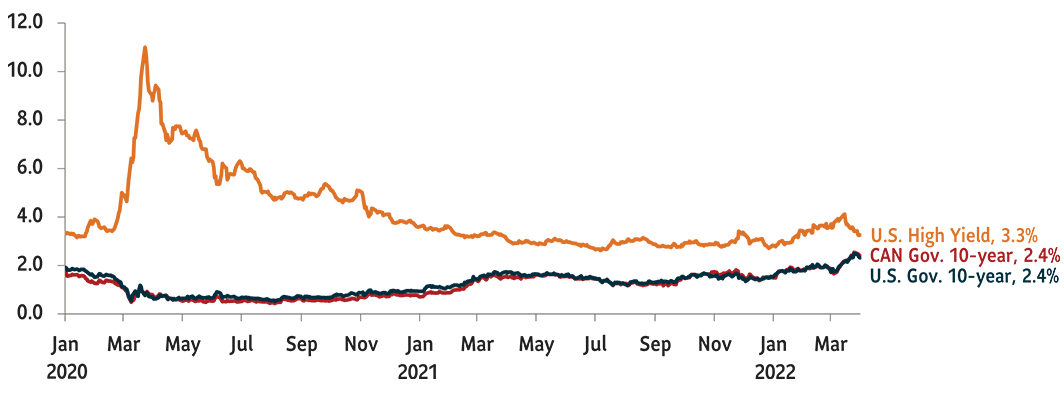

Adding bonds – yields surge on rising rates

In terms of fixed income, the yield on bellwether ten-year U.S. Treasuries surged to 2.32% at quarter end, driving down bond prices in the process (Chart 2.) At one point late in Q1 the gap between yields on two-and 10-year Treasury notes briefly inverted. A sustained yield curve inversion, when short-term rates rise above the yield on longer-term rates, often indicates that a recession is around the corner. However, given the current strength of the U.S. economy, we don’t believe that will occur this year.

When yields reached 2%, we believed the risk/reward equation had come more into balance. And we reduced our cash weighting and increased our exposure to U.S. Treasuries and Canadian bonds, as a result increasing duration in the portfolios. As well we remained overweight high-quality, high-yield corporate bonds. But we have been reducing and upgrading our exposure due to tight spreads and a weakening risk profile.

Where do interest rates head from here? As noted, the market has priced in as many as seven, quarter-point Fed rate hikes this year. The Bank of Canada is expected to follow a similar rate trajectory. However, the IMF is predicting a slow down (in part hindered by COVID-19 and the war in Europe) and has cut its global economic growth target by half a percent to 4.4% for 2022.

Chart 2: Rising yields on 10-Yr Treasuries

Source: Bloomberg. Data as of March 31, 2022.

Overweight U.S.: money flows into tech giants

In terms of the U.S., the country’s strong Q1 jobs report, and a 3.6% unemployment rate was overshadowed by war, inflation, and interest rate worries. Indeed, consensus forecasts suggest U.S. growth in Q2 will fall from 4.3% to 3.5%. However, U.S. households are sitting on US$2.5 trillion in excess savings. And while concerns over inflation and the Russia/Ukraine war appear to have hurt U.S. consumer confidence, strong household balance sheets could continue to support the economy. Further, the U.S. economy is not as exposed to Russia as Europe’s is. Hence, we may see U.S. large cap names hold up better in an uncertain market as investors seek potential security in stronger balance sheets.

Throughout much of the market’s two-year long rally off the March 2020 bottom, we have largely maintained our weighting in high-quality growth stocks. This worked as a counterweight to our exposure to value and cyclical stocks. And as noted in Q1 we added to our weighting in high quality growth, bringing us to a 2.2% overweight position in U.S. equities. This strategy worked well in Q1, with high-quality growth stocks leading the rebound following the market selloff in early March.

Europe: war, inflation – our largest underweight

As noted, the crisis in Ukraine appears to pose a greater risk to Europe’s economy than it does to the U.S. In fact, the MSCI EAFE Index was down 6.96% in Canadian dollars on March 31, while the S&P was down 5.66%. Coming into the year, Europe already faced challenges from rising prices and slowing growth. But given the EU’s greater trade exposure to Russia, eurozone growth prospects have been cut, with Barclays reducing its forecast for 2022 by 1.7% to 2.4%.

Moreover, Germany’s economy (Europe’s export engine) shrank by 0.2% in the last quarter of 2021. The slowdown from the war could now push it into a shallow recession. Furthermore, Russia currently supplies 45% of Europe’s natural gas and 20% of its oil, and Germany has warned that its share of natural gas may have to be rationed. Even before rationing, rising energy prices had contributed to a 25.9% increase in Germany’s producer price index in the March. This drove prices up broadly, including for industrial metals, a key component in manufacturing and ultimately exports. Given the challenges the European economy faces, we remained 1.4% underweight to international equities with exposure to Europe.

Canada: neutral but positive on the economy

Going into the Russia/Ukraine war, Canada’s economic strength was reflected in a strong housing market and an employment rate that was back above pre-pandemic levels. As well, as the post-pandemic economy continues to improve globally, there has been a growing demand for commodities, particularly natural gas and oil. To help reduce Europe’s dependency on Russian oil, the federal government has agreed to increase oil exports by 4%. This would add about 300,000 barrels a day, to the record 4.7 million barrels a day the country was already producing. This, at time when benchmark West Texas Intermediate oil was trading in the US$100 a barrel range at quarter end, after hitting a high of US$123.70 on March 9.

The S&P/TSX Composite Index, with over a 25% weighting in energy and materials, has benefitted from the increased demand for commodities. In fact, while the S&P 500 was down 5.66% in Canadian dollars on March 31, the S&P/TSX was up 3.8%. However, given the volatility in commodity prices, and lack of diversification in the index, we remain neutral on Canada at this point.

China slows, COVID-19 spreads – neutral on EM

With memories of the 1997 Asian currency crisis in the background, Russia’s Ukraine invasion and subsequent collapse of the ruble caused stocks, bonds and currencies to fall sharply across emerging markets in Q1. The MSCI Emerging Markets Index was down 7% in Canadian dollars on March 31. Moreover, Russian equities, which MSCI Inc. no longer considers investible, were removed from the index.

Growth was declining in China prior to the outbreak of war. It had been slowed by the country’s zero-tolerance COVID-19 policy, supply chain bottlenecks and high debt levels in the real estate sector. China’s COVID-19 and supply chain problems came in focus near quarter-end, when the government all but locked down Shanghai, a city of 26 million people and a hub for finance and international business. The city is also home to the world’s largest container-shipping port.

China has cut interest rates to stimulate growth. However, China, accounts for about one-third of global manufacturing, and an economic slowdown will have a negative impact on global economy. More broadly, inflation, surging oil prices and a strengthening U.S. dollar could all combine to hurt emerging markets in the coming months. Hence, we held to our neutral weighting.

This article contains information in summary form for your convenience, published SLGI Asset Management Inc. Although this article has been prepared from sources believed to be reliable, SLGI Asset Management Inc. cannot guarantee its accuracy or completeness and is intended to provide you with general information and should not be construed as providing specific individual financial, investment, tax, or legal advice. The views expressed are those of the author and not necessarily the opinions of SLGI Asset Management Inc. Please note, any future or forward looking statements contained in this article are speculative in nature and cannot be relied upon. There is no guarantee that these events will occur or in the manner speculated. Please speak with your professional advisors before acting on any information contained in this article.