MAY 04, 2022

The Fed’s race to ‘neutral’ and beyond

With larger rate hikes, the US Federal Reserve is expected to take the federal funds rate to or above the neutral rate of interest to fight inflation. While the fed rate at neutral would neither restrict nor support growth, fed rates above neutral could weigh on both growth and inflation.

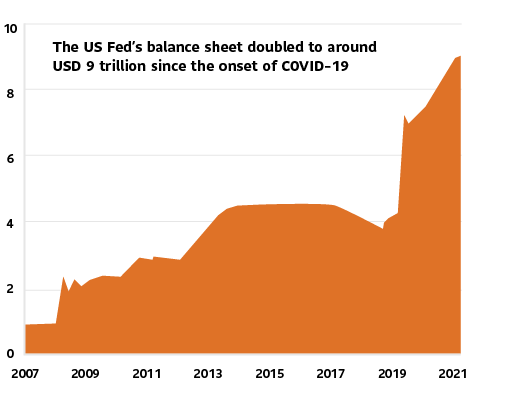

Source: US Federal Reserve

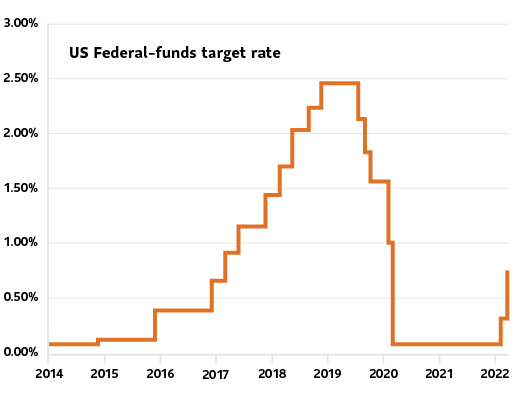

Source: Federal Reserve via St. Louis Fed

As anticipated, the US Fed raised interest rates by 50 basis points (bps) during its policy meet on May 3 and 4. The Fed hasn’t hiked interest rates by 50 bps since the 2000’s, but with headline consumer price inflation at 8.5%—the highest in over 40 years—this bolder move was deemed necessary.

The Fed also signalled similar rate hikes over the next couple of meetings. With such moves, it appears the Fed is aiming to take the federal funds rate to or above the neutral rate of interest in its fight against inflation.

But a neutral interest rate isn’t easy to spot

The neutral rate is influenced by demographics, inflation expectations and productivity amongst other dynamic factors. The measure is so elusive that St. Louis Fed President James Bullard once called it the ‘The Phantom Menace’.

And the menace has only grown challenging since. This time around, in addition to interest rate hikes, the Fed laid out its plan to shrink its balance sheet by around $1 trillion dollar a year, faster than the last quantitative tightening cycle of 2017-2019. The effects of a balance sheet runoff aren’t particularly well-known, but it points to financial tightening.

Markets are taking the cues

Amidst bouts of volatility ahead of the meeting, the S&P 500 fell nearly 9.1% and the Nasdaq slid 14% during April. Further, 30-year mortgage rates in the U.S. surpassed 5% for the first time since 2011. A Bloomberg index tracking U.S. financial conditions contracted to -0.73 in late April, the tightest levels since the COVID-19 induced shock of March 2020.

All said, the Fed’s Summary of Economic Projections released in March forecast a median federal funds rate of 1.9% for 2022 and 2.8% for 2023. The Fed’s median for neutral rate was estimated at 2.4%. We expect the Fed to be more data dependent on its interest rate decisions after the relatively large initial moves.

What does this mean for Sun Life Granite Series of Funds?

Our series of funds remain tactically overweight equities and underweight bonds. In the second half of Q1, we added to our core bond allocation as the risk profile had incrementally become more attractive with the rise in yields. We also added to quality (active management) and tilted our portfolios back towards US growth stocks as we believed to be heading into an environment of slower growth and rising risks.

Disclosure

This article contains information in summary form for your convenience, published SLGI Asset Management Inc. Although this article has been prepared from sources believed to be reliable, SLGI Asset Management Inc. cannot guarantee its accuracy or completeness and is intended to provide you with general information and should not be construed as providing specific individual financial, investment, tax, or legal advice. The views expressed are those of the author and not necessarily the opinions of SLGI Asset Management Inc. Please note, any future or forward looking statements contained in this article are speculative in nature and cannot be relied upon. There is no guarantee that these events will occur or in the manner speculated. Please speak with your professional advisors before acting on any information contained in this article.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.