Q3 2022 | Market Update

Market’s rollercoaster ends Q3 with a sharp decline amid central banks commitment to higher rates for longer

Market’s rollercoaster ends Q3 with a sharp decline amid central banks commitment to higher rates for longer

Opinions as of September 30, 2022

Global financial markets extended their losses in the third quarter. A combination of central banks around the world hiking rates, persistent inflation, currency, and bond market volatility, and rising geopolitical concerns produced a massive selloff across all markets.

The quarter started off with a rally fueled by signs of inflation peaking, and expectations that the U.S. Federal Reserve (the Fed) could soon end its rate-hiking cycle, and pivot to lowering rates due to slowing growth. U.S. Inflation figures dropped to 8.3% in July, down from the 9.1% in June. Investors viewed the signs as encouraging and, as a result, markets rallied. Then came the Jackson Hole Symposium in late-August, where U.S. Fed chairman Jerome Powell’s commented that rates are going to stay higher for longer, even if it may cause pain to businesses and households. Markets got spooked and the selloff frenzy ensued throughout the rest of the quarter, wiping out all previous gains from July. U.S. August inflation data came in at 8.3%. Although headline inflation was lower, core inflation was significantly higher. A higher core inflation, which discounts the volatile contribution from food and energy prices, is concerning for the Fed and markets participants alike, thus exacerbating the selloff.

As central banks across the world reiterated their stance of aggressively hiking interest rates in response to persistent high inflation, risks of a global recession became elevated, particularly in the Eurozone. The U.S., UK, and Canada also saw their probability of a recession increase.

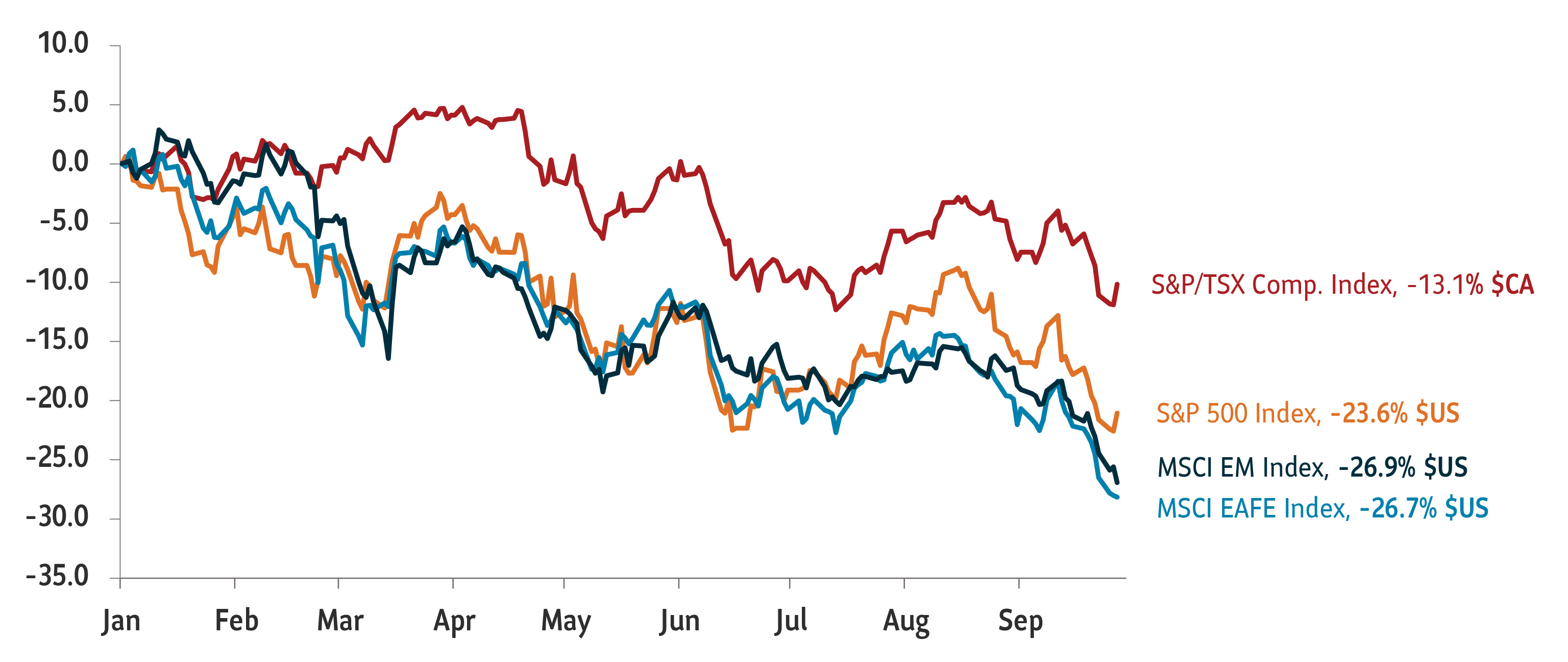

Equity markets were down sharply.

Chart 1: Major markets take a hit in Q3

Total return, indexed to 0 as of January 1, 2022

Source: Bloomberg. Data as of September 30, 2022.

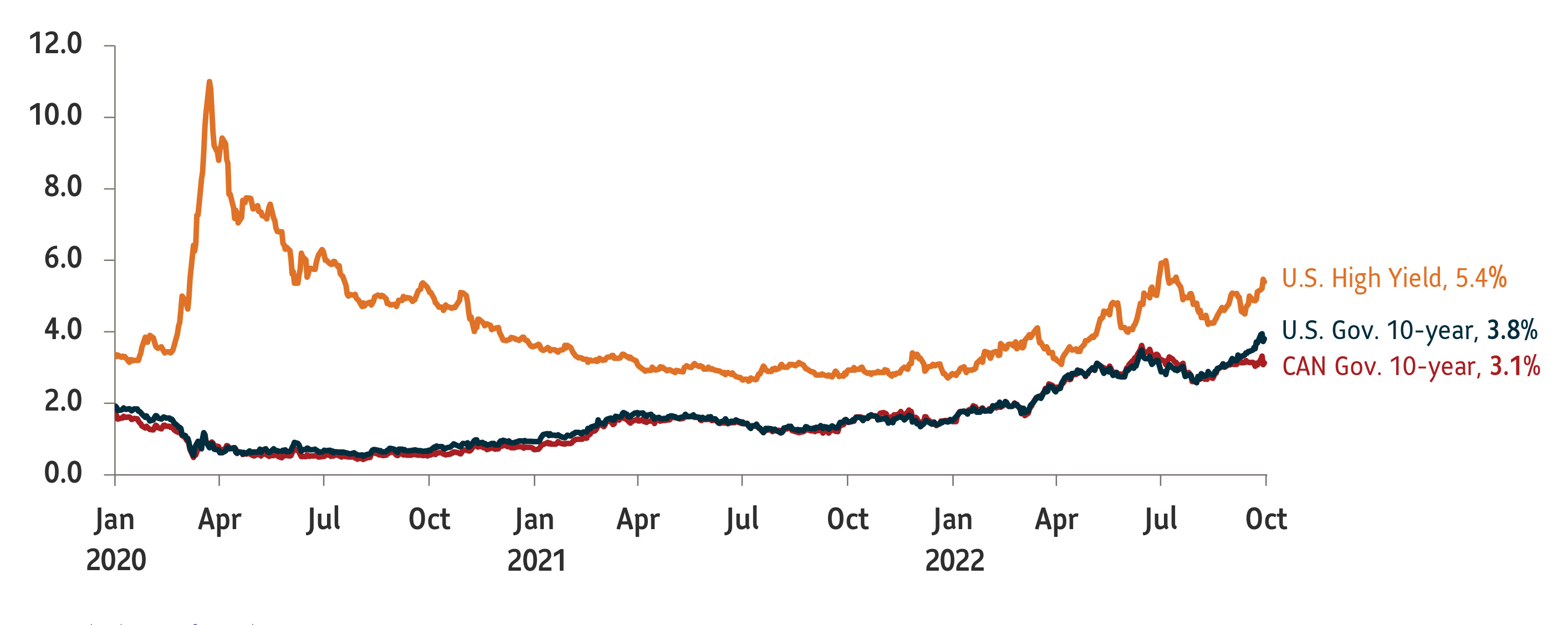

Fixed income markets did not provide any safety from the decline in equities. Most bond markets posted negative returns. Global sovereign bonds were sharply down after the UK’s fiscal policy statement included a tax cut for the wealthy. The news was negatively received by markets, and the British pound fell to an all-time low against the U.S. dollar.

The yield curve is now quite significantly inverted, which is a commonly accepted sign of a looming recession.

Source: Macrobond. Data as of September 30, 2022.

Equities: Underweight cyclical equities and trimmed U.S. equity exposure

We are concerned about an earnings recession in a slowing growth environment. We believe the U.S. has entered a slowing growth period, and the picture in Europe looks even more dire. Markets will continue to pay close attention to the Fed’s actions for direction. Moreover, a strong U.S. dollar could spell trouble for corporate earnings. Although supply chains issues have begun to normalize, we see signs of weakening demand. This shows that the Fed’s tightening actions are beginning to trickle into the demand side. We continued to take advantage of the equity rally to trim our exposure to U.S. equities and increased our cash exposure. Our positioning also favours defensive equities over cyclicals.

Fixed Income: Overweight cash in light of rising yields as central banks move to rein in inflation

With monetary policy expected to stay tighter for longer, we expect credit markets to remain quite volatile. Corporate default rates are still quite low, although they may move up during an economic slowdown. The high yield space, particularly, has not fully priced in the probability of a recession in our view. As a result, we tactically removed sensitivity towards high yield spreads. We remain overweight Canadian bonds as our outlook for Canadian core bonds is positive. We expect to deploy cash into fixed income with more favourable valuations and yields.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.