INFLATION | YIELDS | VALUATIONS

Rising inflation

The recent high inflation surprises appear to have been driven by transitory re-opening factors such as increased demand for used cars, a resumption of air travel, and a rise in the cost of restaurant food as consumers returned to in-restaurant dining. Continuing supply chain disruptions are another factor, with, for example, a strong surge in demand for semiconductors leading to a global shortage of chips needed in a broad range of products ranging from cars to video game consoles to computers. Although these supply disruptions will eventually normalize, it’s important to note that transitory inflation might stay elevated for longer than we think, because the world is not re-opening simultaneously, especially with the additional complication of new variants.

Low yields

Although interest rates are gradually increasing, we expect levels could remain low relative to history, which means lower cost of capital for investments and lower debt carrying costs for consumers and companies. We expect a gradual rise in yields from here as central banks appear to still be accommodative and view short term inflationary pressures as transitory. However, any indication otherwise, or an event like a poor Treasury auction, could trigger a sharp rise in yields and result in a risk asset sell off.

At the recent Jackson Hole symposium, Federal Reserve Chair Jay Powell reiterated the Fed’s dual mandate of maximum employment and price stability. He highlighted that while the pace of recovery has exceeded initial expectations with output surpassing prior peak in four quarters, the recovery in employment has lagged and been uneven. In-person service industries, which employ millions of workers, remain challenged both by inconsistent demand and worker shortage. While communicating that it might be time to commence a reduction of asset purchase program (quantitative easing or QE), he emphasized the taper would not necessarily signal or lead to a hike in interest rates. A change in interest rates would be subject to more stringent and substantive indications of sustained maximum employment similar to pre-pandemic levels.

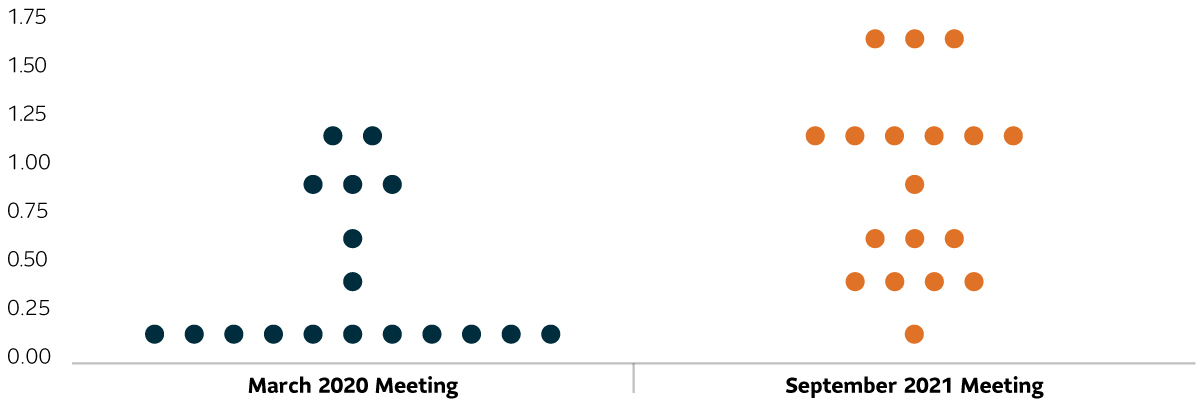

The Federal Open Market Committee (FOMC) dot plot (Chart 1) still shows a strong base expecting no rate hikes by year end 2023. However, movement up of several dots indicating a potential of up to two interest rate increases in 2023, versus a strong view in early 2020 that there would not be an increase until after 2023. The new Fed monetary policy regime is focused first on full employment and secondarily, targeting an average 2% inflation over the cycle. The change in language to “flexible average inflation target” (FAIT) provides the Fed with a lot of flexibility to respond to short term inflationary pressures.