Q4 2022 | Market Update

Rapid interest rate hikes reset valuations for major asset classes in 2022. We expect the focus to turn to concerns about growth and earnings slowing down in 2023.

Rapid interest rate hikes reset valuations for major asset classes in 2022. We expect the focus to turn to concerns about growth and earnings slowing down in 2023.

Opinions as of January 13, 2023

2022 challenged major financial markets and asset classes in many ways. During the year, inflation hit a four-decade high in June of 9.1%. The U.S. Federal Reserve (the Fed) hiked its benchmark target interest rate from a range of 0% to 0.25% in January 2022 to a range of 4.25% to 4.50% in December, the highest since 2007. Geopolitical tensions, heightened by Russia’s invasion of Ukraine disrupted energy markets. China’s strict Zero-Covid policy also continued to stress supply chains for most of the year. Unsurprisingly, stocks and bonds faced severe volatility in 2022.

Inflation stayed uncomfortably high and far above the Fed’s targeted limit of 2%. As a result, the Fed remained resolute in its fight against increasing prices.

Given this backdrop, equities experienced a few bear market rallies – a brief rally followed by a reversal in gains. In 2022, the S&P 500 index lost 19% and the tech-heavy Nasdaq index slumped 33%. Canada’s S&P/TSX Composite fared better and fell 8.5%. International markets also suffered – both developed and emerging equity markets suffered double-digit losses. High-flying growth stocks gave up a large part of their gains from the past few years and value stocks outperformed growth stocks in 2022.

Chart 1: Major equity markets take a hit in 2022

Total return, indexed to 0 as of January 1, 2022

Source: Bloomberg. Data as of December 31, 2022.

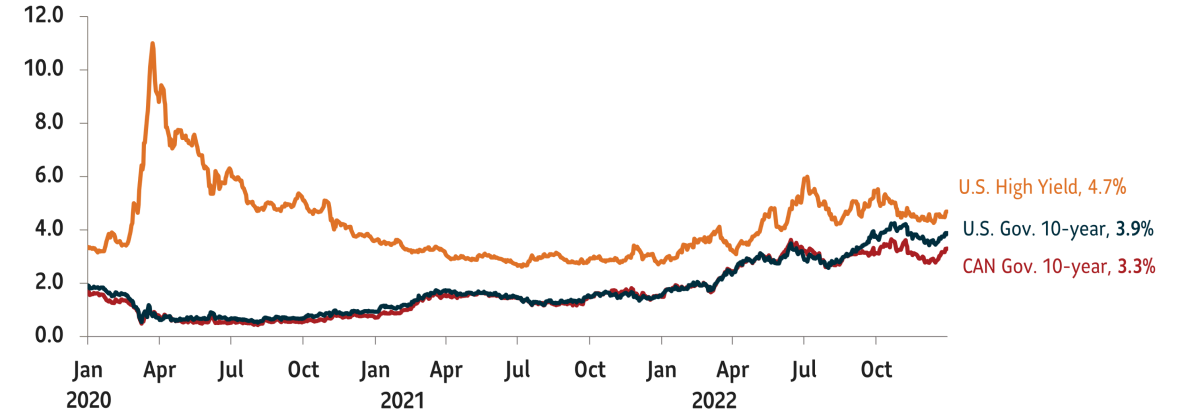

Tighter monetary policy in 2022 hit bonds especially hard. As the Fed hiked rates rapidly, the yield on the 10-Year U.S. Treasury rose as high as 4.3%, the highest since 2008. While the U.S. 10-Year Treasury relented to end the year with a yield of 3.9%, the Bloomberg U.S. Treasury Index returned negative 12.5%, the index’s biggest loss in its four-decade history. Global bonds entered their first bear market in a generation when the Bloomberg Global Aggregate Total Return Index fell 20% from its 2021 high in September. While global bonds have since recovered a bit, losses lingered until the end of 2022.

Chart 2: U.S. and Canada 10-year bond yields end 2022 higher

Source: Macrobond. Data as of December 31, 2022.

The Fed’s monetary medicine, however, is having its intended impact. Inflation slowed for the sixth straight month in December, falling to 6.5%. While this inflation downtrend is encouraging, we believe that it will take more time to achieve the Fed’s targeted upper limit of 2%. That’s because even as goods inflation has fallen, the stickier services inflation could prove a challenge for the Fed.

In 2023, we expect the markets’ focus to shift towards slowing growth. With easy money policies ending, interest-rate sensitive sectors like housing and manufacturing are feeling the impact. Overheated housing markets across the U.S. and Canada are slowing, and indicators of global manufacturing trends are showing signs of a contraction. Consumer sentiment and confidence is waning across developed markets. Despite all these downtrends, labor markets across the U.S. and Canada have stayed resilient.

We believe the Fed will continue to focus on driving inflation down over employment. While markets expect a quick Fed ‘pivot’ – a shift from the current rate hiking phase to a rate cutting one – we think the Fed will pause rate hikes and hold them at current levels to suppress prices and regain their inflation fighting credibility.

Modestly underweight equities

Tactically we remain modestly underweight equities. While 2022 reset valuations to realistic levels, we expect 2023 to do the same with earnings. We believe estimates for earnings haven’t been revised down enough to reflect a possible growth slowdown in the coming quarters. Also, the boost to corporate earnings from inflation is likely to dissipate over the next few quarters, which would put pressure on profit margins. We are underweight international developed equities, especially Europe, where the monetary tightening cycle could linger longer than in North America. We remain neutral on emerging market equities as China’s economy could get a lift with the end of the ‘Zero-Covid’ policy. We also believe a weaker U.S. dollar could provide a boost to economic conditions in emerging markets.

Positive on high quality and investment grade fixed income

We continue to favor bonds and maintain our overweight position in Canadian bonds and in U.S. investment grade (IG) bonds. We believe that the Canadian IG sector, with higher exposure to government over corporate securities, can better withstand slower economic growth. We are underweight high yield bonds. We estimate the compensation provided by the current level of yields to be inadequate for a possible scenario of slowing growth or recession.

This article contains information in summary form for your convenience, published SLGI Asset Management Inc. Although this article has been prepared from sources believed to be reliable, SLGI Asset Management Inc. cannot guarantee its accuracy or completeness and is intended to provide you with general information and should not be construed as providing specific individual financial, investment, tax, or legal advice. The views expressed are those of the author and not necessarily the opinions of SLGI Asset Management Inc. Please note, any future or forward looking statements contained in this article are speculative in nature and cannot be relied upon. There is no guarantee that these events will occur or in the manner speculated. Please speak with your professional advisors before acting on any information contained in this article.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.