Q1 2023 | Market Update

Markets rollercoaster through a volatile first quarter after interest rates expectations fluctuate.

Markets rollercoaster through a volatile first quarter after interest rates expectations fluctuate.

Opinion as of April 5, 2023

Highlights

Markets started the quarter with a rally driven by slowing inflation data and expectations that the U.S. Federal Reserve (the Fed) would cut interest rates by mid-2023. Early optimism waned in February after inflation data showed prices falling more slowly than anticipated, and the Fed pushing back against hopes of rate cuts. In March, a bank run on Silicon Valley Bank (SVB), triggered contagion fears, and ultimately led to a state-backed rescue of Credit Suisse. Markets initially plunged following the banking turmoil, however swift actions from the Fed, U.S. Treasury officials, and the Federal Deposit Insurance Corporation (FDIC)to insure depositors reassured markets, and prevented further potential bank runs.

In what became one of the most anticipated Fed meetings in recent memory, the Fed raised rates by 25 basis points (bps) on March 22. Markets were largely expecting a 50bps rate hike prior to the banking trouble when rate change expectations varied between a cut and an increase of 50 bps. The Fed’s 25 bps hike represents its commitment to price stability while also acknowledging financial stability concerns, while it also indicated that the battle to tame inflation isn’t over.

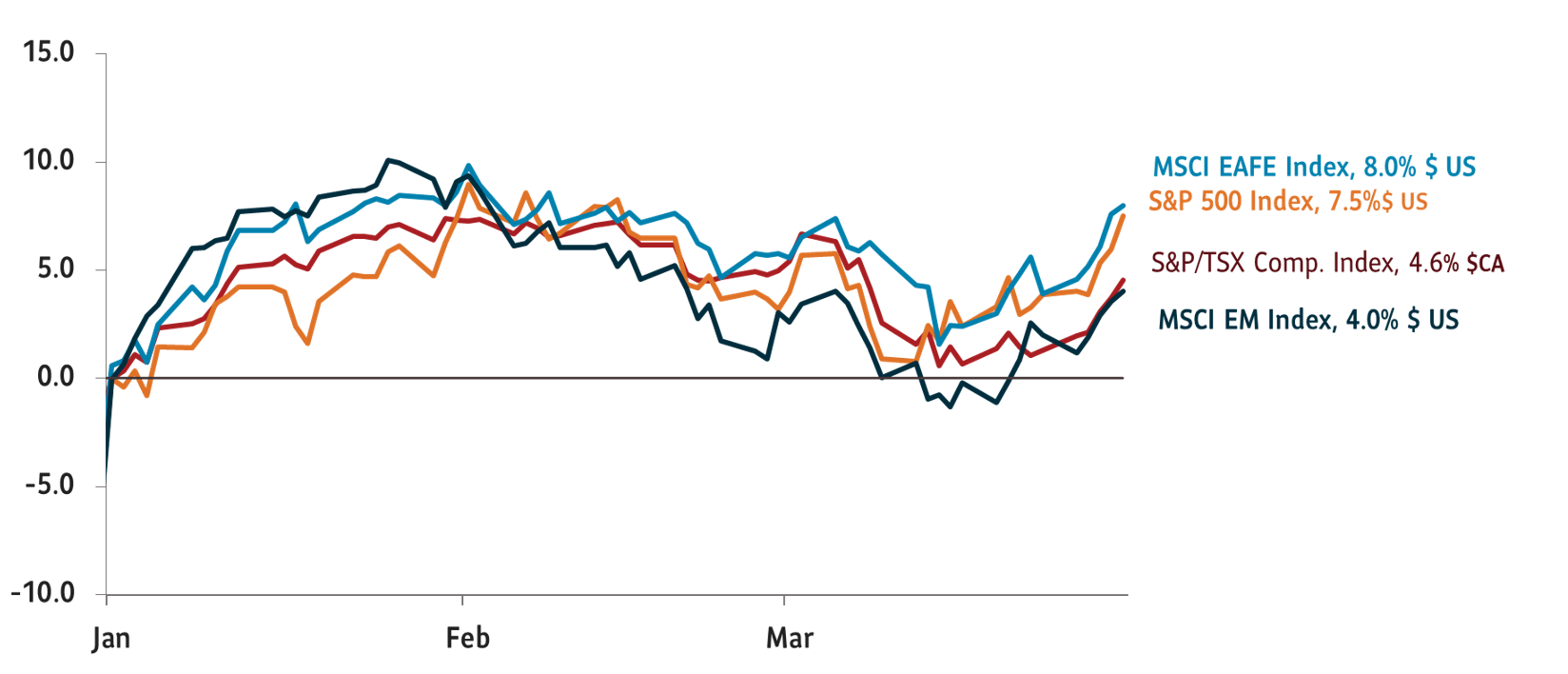

In response to concerns that financial stability risks may speed up an economic downturn, markets renewed expectations of rate cuts in late 2023, and equities rallied to end the quarter in positive territory. The S&P 500 rose 7.5%, while the tech-heavy Nasdaq gained 20.8%. Sentiment of market participants is now more bullish. We believe this is premature, and don’t think the risk-reward trade-off is attractive especially given a rally in riskier assets.

Total return, indexed to 0 as of January 1, 2023

Source: Bloomberg. Data as of March 31, 2023.

A rate cut is not our base case for 2023 as central banks now have the challenging task of balancing price and financial stability, and it must do so with falling, yet stickier, inflation. While indicators point to a softening in economic activity and demand cooling, we think markets’ expectations of a rate cut are premature and that rates may stay higher for longer than anticipated.

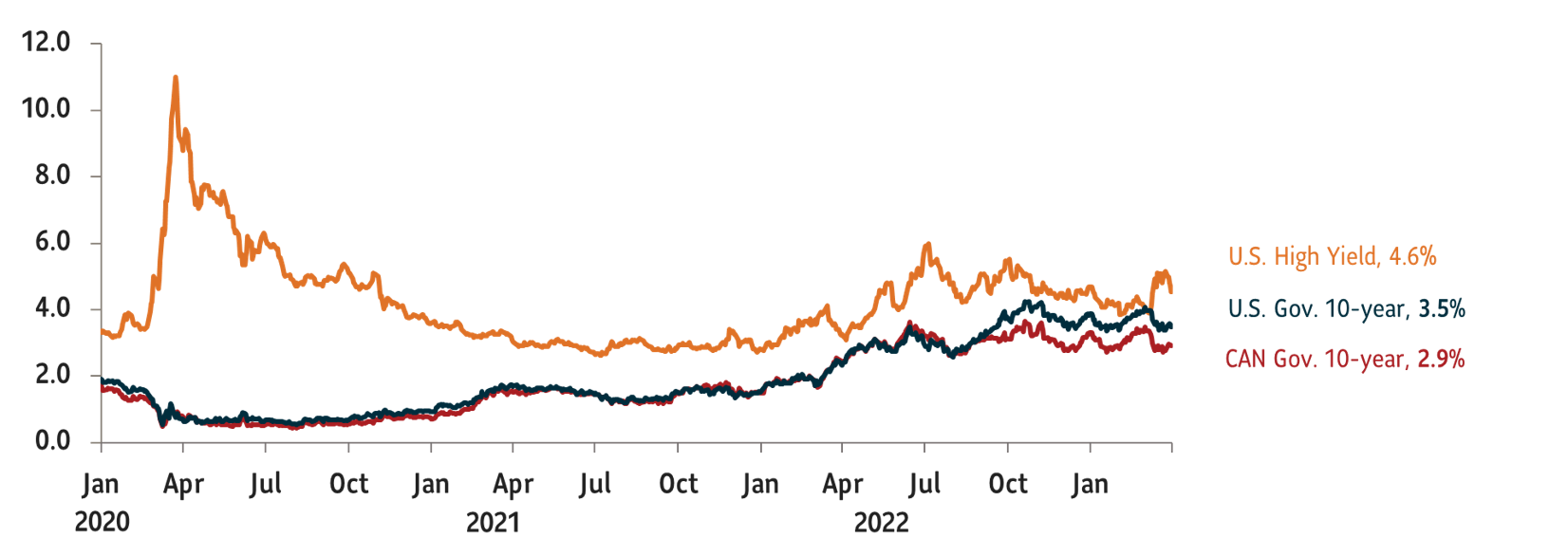

Chart 2: U.S. and Canada 10-year bond yields

Source: Macrobond. Data as of March 31, 2023.

We believe central banks like the Fed and the Bank of Canada are still far from their 2% inflation target but are committed to do what is necessary to achieve it. On the other hand, economic activity may further deteriorate as the effects of higher rates continue to materialize and challenges in US regional banks contribute to tighter lending standards.

Positioning

Equities: We remain underweight equities given our base case that earnings may further contract as economic activity slows and profit margins come under pressure.

Fixed Income: We are overall neutral fixed income. Within fixed income, we are overweight investment grade bonds due to higher quality. Given the prospect of an economic slowdown, we favour U.S. treasuries and treasury inflation-protected securities (TIPS). We are underweight high yield bonds as we believe yield spreads don’t reflect the sector’s challenges.

Cash: We hold a modest amount of cash giving us the optionality to put the funds to work as opportunities present themselves while earning an attractive yield

This article contains information in summary form for your convenience, published SLGI Asset Management Inc. Although this article has been prepared from sources believed to be reliable, SLGI Asset Management Inc. cannot guarantee its accuracy or completeness and is intended to provide you with general information and should not be construed as providing specific individual financial, investment, tax, or legal advice. The views expressed are those of the author and not necessarily the opinions of SLGI Asset Management Inc. Please note, any future or forward looking statements contained in this article are speculative in nature and cannot be relied upon. There is no guarantee that these events will occur or in the manner speculated. Please speak with your professional advisors before acting on any information contained in this article.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.