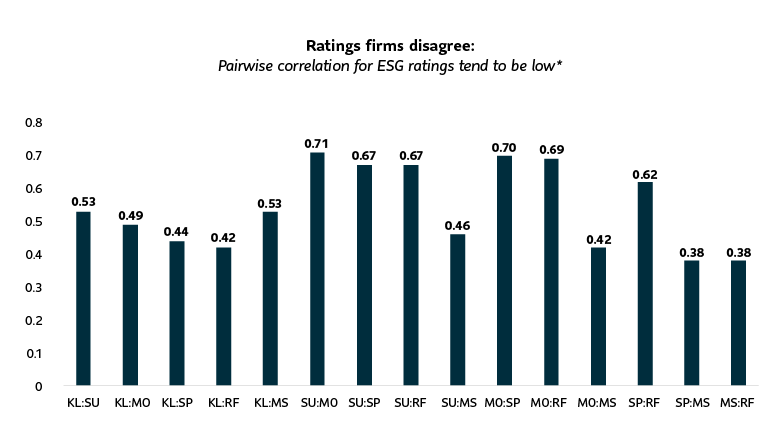

KL – KLD; MO-Moody’s ESG; MS-MSCI; RF-Refintiv; SP-S&P Global; SU-Sustainalytics

*Pairwise correlation measures the relationship between the ESG rankings assigned by two ratings firms for an entity. Pairwise correlation ranges between -1 and 1. If two ratings companies produce the same ratings for an entity, pairwise correlation between the ratings is 1 and if an entity gets completely opposite ratings, then pairwise correlation of the scores is -1. A pairwise correlation of zero signifies there is no meaningful relationship between the rankings issued by two ratings companies for an entity.

Source: “Aggregate Confusion: The Divergence of ESG Ratings”, Florian Berg, Julian F. Kölbel and Roberto Rigobon, April 2022.

On the other hand, ESG ratings firms start with data that is sparse or nuanced, requiring some degree of subjectivity. The other complexity is that ESG ultimately means different things to different data providers. Moreover, the attributes on how a company is ranked often differ from one ratings firm to another. ESG ratings encompasses quantitative information (such as the number of accidents) and qualitative information (such as the policies and remedial actions around workplace safety and quality) in differing proportions. To summarize, differences in ESG ratings between firms broadly stem from:

- Diverging scope: Scope refers to the set of attributes used to derive an ESG assessment. Scope divergence results from two raters considering a different set of attributes. For example, when one ratings firm subjects a company to account for child labor or collective bargaining and another ratings firm does not subject the same company to these attributes.

- Diverging weight: Differing weighting schemes stem from ratings firms taking different views on the relative importance of attributes. For instance, one ratings firm may assign equal importance to labor practices, supply chains and water management for a company while another ratings firm may deem differing levels of importance of these factors to the same company.

- Diverging measurement: Measurement divergence refers to a situation where ratings firms measure the same attribute using different indicators. For instance, one ratings firm may assess a company on water based on water discharge, while another may use water management or water intensity or a combination of several indicators.

Given these differences, research by Berg, Kölbel, and Rogobon, estimate that measurement, scope, and weight explain 56%, 38% and 6% respectively, to the divergence in ESG rankings issued by ratings firms for a company.

Looking through dissimilar ratings

While dissimilar ESG ratings for a company helps to offer a range of opinions, the lack of objective ESG ratings for a company poses challenges. Evaluating the performance of companies, and funds strictly based on ratings then becomes subjective. Additionally, companies receive inconsistent feedback on how and where to deploy resources to improve their ESG performance. Moreover, ESG ratings are generally more focused on risks and opportunities companies face as opposed to the impacts caused by their operations, products and/or services. This infers that improving ESG performance, or a rating does not necessarily contribute towards addressing some of the world’s most pressing challenges.

In the interest of market integrity and financial stability, regulators are stepping in to bring clearer disclosures and reporting standards for ESG ratings. The Securities Exchange Commission (SEC) in the U.S. has readied an ESG-related proposal demanding companies to disclose climate-related information. The European Union’s corporate sustainability reporting directive is aiming for a law to force 49,000 companies doing business in the 27-country member bloc to reveal sustainability information. Additionally, the European Fund and Asset Management Association (EFAMA) has recommended rules to ensure that ratings firms are transparent in their data sources and methods that go into their ratings. These developments could go a long way to standardize the ratings framework.

But for now, fund managers can extract specific information from one or multiple rating firms for investment research. Similarly, in addition to considering ESG ratings, some asset managers may apply their own weightings as a component of their disciplined investment process.

Regardless of the approach, a clear and thorough explanation of a proprietary ESG process could help clear the confusion for clients and help them differentiate the ESG decision-making approach used by various fund managers.

We believe ESG ratings will evolve to reflect the broader changes in ESG investment considerations. Also, we support the evolving regulations and oversight that foster standardization of ESG-related disclosures. Until then, ESG ratings will be one of the many tools to assess a company’s ESG commitments. For now, a single ESG rating is just one informed opinion of many to help guide making investment decisions.

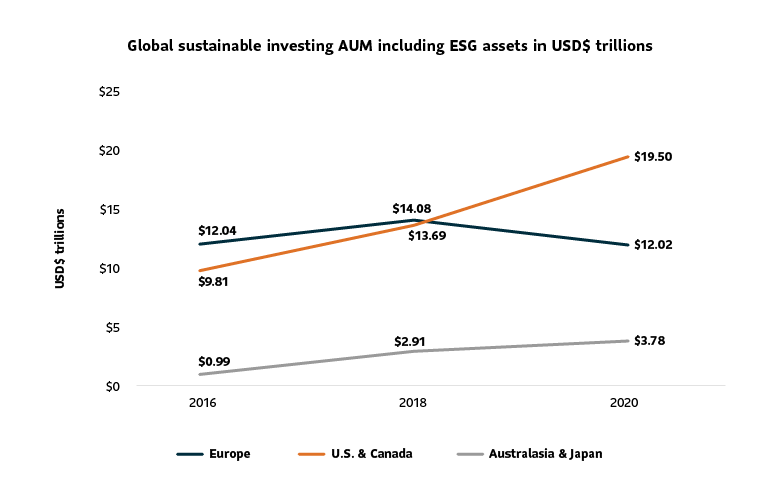

1 “Global Sustainable Investment Review 2020,” Global Sustainable Investment Alliance, July 2021.

2 “Aggregate Confusion: The Divergence of ESG Ratings”, Florian Berg, Julian F. Kölbel, Roberto Rigobon, April 2022.

Information contained in this article is provided for information purposes only and is not intended to provide specific financial, tax, insurance, investment, legal or accounting advice and should not be relied upon in that regard. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment fund managed or sub-advised by SLGI Asset Management Inc. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

Information herein has been compiled from sources believed to be reliable as of the date of publication, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.