Finding income in an evolving yield environment

With yields climbing, bond prices have been falling. And investors may see volatility increase in the bond market if interest rates rise in the coming months. As well, with inflation running at nearly 5%* real bond returns (adjusted for inflation) are deeply negative. This combination: inflation and uncertainty around rising interest rates, is making it difficult to invest for income. In this article, we’ll look at how we’re addressing these challenges by broadening out our sources of returns, and why bonds should still be a key part of portfolios.

*Source Statistics Canada, January 1, 2021

Bonds: still a core building block in portfolios

Fixed income securities are important building blocks in a diversified portfolio, providing four key benefits:

- Capital preservation: Higher-quality fixed income securities, issued by entities such as governments, corporations and financial institutions are an important source of potential capital preservation and security.

- Income: The coupon (interest payments) is a critical source of income, historically providing most of the returns on bonds. And these coupons provide a buffer, potentially preserving capital when interest rates rise.

- Liquidity: Deep secondary markets exist for fixed income securities. This allows investors to quickly liquidate or rebalance portfolios.

- Diversification: Higher-quality fixed income returns generally have had low correlations with riskier asset classes. This diversification may help smooth out portfolio returns.

Looking beyond government bonds for enhanced returns

Given the evolving market conditions, it can be challenging to generate income, find liquidity and preserve real (inflation adjusted) capital over longer periods. In fact, Canada’s broad fixed income market generates an average annual yield of around 1.9%*. This is just below the 2% mid-point of the Bank of Canada’s target inflation range of 1% to 3%.

*Source: FTSE. Data: December 31, 2021

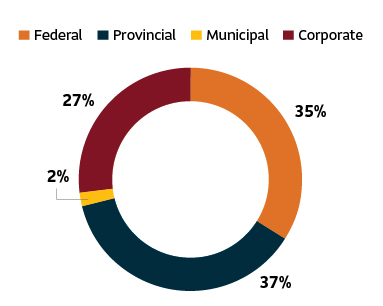

Within Canada’s fixed income market there is a strong bias towards high-quality, lower-yielding government issues. But Canada’s corporate bond market is much smaller. This results in fewer options to derive longer-term returns and income generation domestically from this traditional core building block.

Given this, broadening out the source of returns can play an important role in potentially enhancing returns. To do this, we focus on:

- Building a strong foundation in core Canadian bonds.

- Investing in a wide range of complementary sources of returns. Including in varying interest rates, countries, currencies, corporate bonds, and liquidities. This broader approach within Canada and globally helps us strive for reasonably consistent, excess returns over Canadian bonds.

- Using a flexible multi-manager structure that evolves with changing market conditions –tactically over the shorter term, and strategically over longer periods.

FTSE Canada Universe Bond Index

| Modified duration | 8.43 years |

| Average yield | 1.92% |

Source: FTSE. Data: December 31, 2021.

Over the long-term, diversifying with fixed income could continue to play a pivotal role in portfolio protection. This makes positioning within the fixed income market equally important. And given the outlook for interest rates, understanding the role of the various underlying components of a fixed income portfolio, is more critical than ever. To that end, multiple building blocks, return sources and tactical asset allocation will be key to navigating this changing yield environment.

Important information

This document is published by SLGI Asset Management Inc. and contains information in summary form. This document is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

Information contained in this document is provided for information purposes only and is not intended to provide specific financial, tax, insurance, investment, legal or accounting advice and should not be relied upon in that regard. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment fund managed or sub-advised by SLGI Asset Management Inc. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell securities.

Information herein has been compiled from sources believed to be reliable as of the date of publication, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

This document may contain forward-looking statements about the economy, and markets; their future performance, strategies or prospects. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon. Forward-looking statements involve inherent risks and uncertainties about general economic factors, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. You are cautioned to not place undue reliance on these statements as a number of important factors could cause actual events or results to differ materially from those expressed or implied in any forward-looking statement. Before making any investment decisions, you are encouraged consider these and other factors carefully.

Group Retirement Services (GRS) are provided by Sun Life Assurance Company of Canada. Sun Life Granite Target Date Funds are segregated funds of Sun Life Assurance Company of Canada, managed on a sub-advisory basis by SLGI Asset Management Inc. Sun Life Granite Target Risk segregated funds launched November 2009 and were managed on behalf of GRS by Sun Life Assurance Company of Canada. In 2012, SLGI Asset Management Inc. launched Sun Life Target Risk mutual funds, at which time the Sun Life Granite Target Risk segregated funds were closed and new funds were created that invest in mutual funds with a similar mandate to each of those funds.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.