Q3 2023 | Market Update

Equities suffered as borrowing costs hit multi-year highs. Tight financial conditions in the U.S. also hurt bond markets across the globe.

Equities suffered as borrowing costs hit multi-year highs. Tight financial conditions in the U.S. also hurt bond markets across the globe.

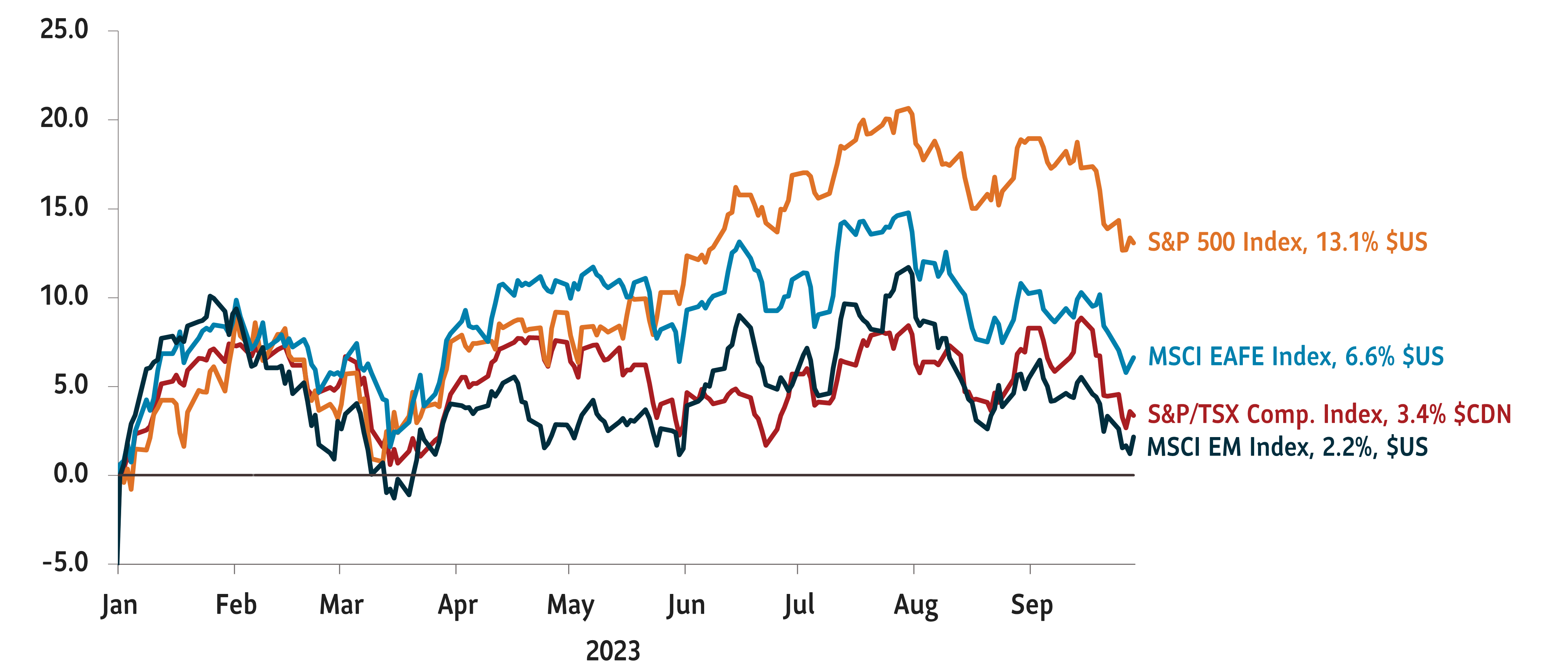

The euphoria that defined the beginning of Q3 this year for U.S. equities largely disappeared at the end of September. Earlier during the quarter equities rallied on hopes that U.S. technology stocks would greatly benefit from artificial intelligence. Markets also expected the U.S. Federal Reserve (the Fed) to bring down inflation to its target level of 2% without sacrificing employment and output.

Source: Bloomberg. Data as of September 30, 2023.

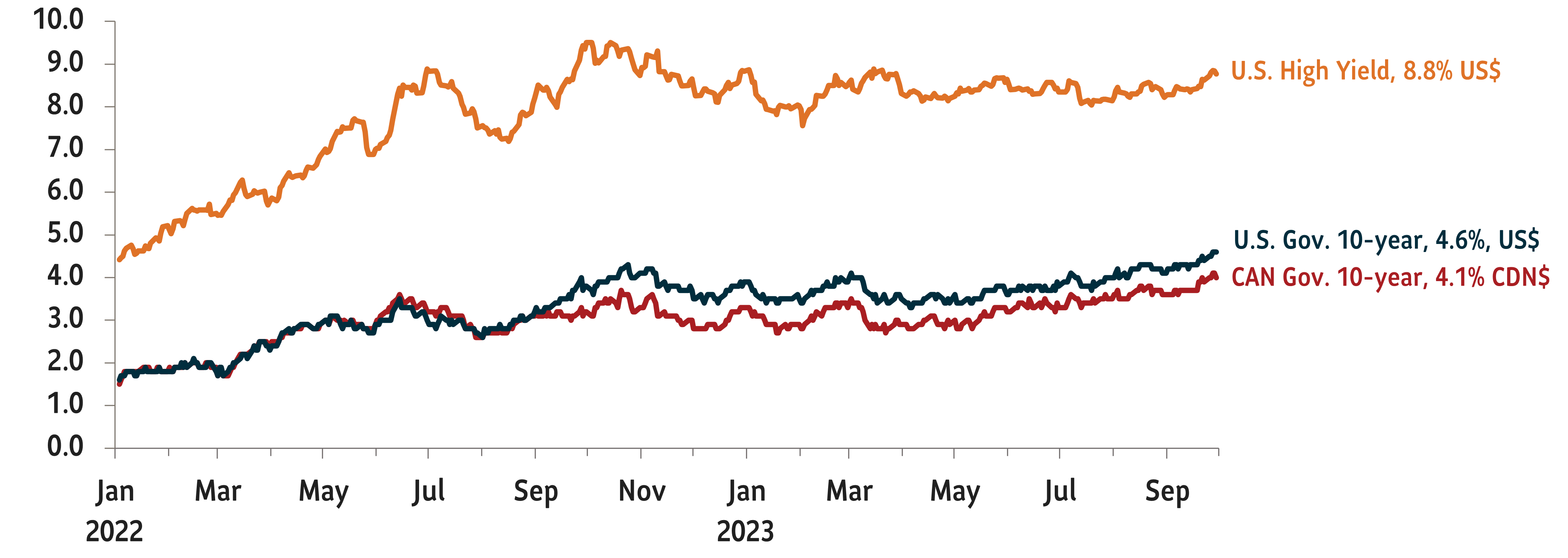

To some extent, resilient economic data confirmed the market’s optimism for the economy. The Fed’s fastest interest rate hiking cycle in decades caused borrowing costs to rise to over 5.5% from near 0% levels in just 18 months. This brought down inflation to 3.7% in August 2023 from 9.1% in June last year. For a while, markets seemed to ignore the potential impact of higher interest rates.

But midway through the quarter, markets started to suffer from the Fed’s tight monetary policy. The yield on the 10-year U.S. Treasury note, which dictates interest costs for everything from housing to cars for consumers and business funding costs, swiftly rose from 3.6% in mid-July to 4.8% in late-September. This rapid rise in yields is likely due to the resilient economy and concerns about debt-fueled deficit spending in the U.S.

As yields on relatively risk-free short-term government securities rose above 5%, risky equities suddenly seemed expensive, and this triggered a sell-off in equities. Both the S&P 500 Index and NASDAQ Composite Index lost around 5% in Q3 2023. Bond market volatility also jumped to its highest level since May. Losses on some long-term U.S. Treasury bonds approached over 40%.

Despite financial tightening and higher yields, the U.S. economy seems resilient. The U.S. unemployment rate remained near historical lows at 3.8% in August and September jobs data was healthy. However, the rest of the world is feeling the impact of higher U.S. borrowing costs. Canada’ s economy, which is already slowing down due to its own tight monetary policy, is further feeling the pressure of higher U.S. yields. As well, the strong U.S. dollar is challenging several emerging economies.

Source: Bloomberg. Data as of September 30, 2023.

In our view, markets are finally coming to terms that interest rates will stay at relatively elevated levels for a longer time. While markets expect the U.S. to avoid a recession, our base case scenario is one of a meaningful slowdown for the U.S. in the face of higher yields.

Despite this, we expect the U.S. economy to relatively outperform developed Europe and emerging markets. For instance, our research shows that manufacturing activity, while still in the contraction phase, is stabilizing in the U.S. In addition, earnings in the U.S. are showing signs of rebounding compared to other developed markets such as Canada and Europe.

In Europe, we expect Germany to face challenges as China, its key export market, continues to fight deflationary conditions. While incoming Chinese data has been encouraging, we feel it is too soon to be optimistic about the country’s prospects. For this reason, we are also cautious about emerging economies that are dependent on commodity exports.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are subject to change and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. This commentary is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Information contained in this commentary has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

This commentary may contain forward-looking statements about the economy and markets, their future performance, strategies or prospects or events and are subject to uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.