April 22, 2022

Opinions and commentary by KBI Global Investors (North America) Ltd., sub-advisor to the Sun Life KBI Sustainable Infrastructure.

The ongoing global energy crisis has been exacerbated by the current geopolitical turmoil between Russia and Ukraine.

This has brought to the forefront our huge dependency on fossil fuels and the challenges associated with weaning away from traditional sources of energy. It has also led to speculation about the future of fossil fuels and renewables. In this commentary, we address several aspects that are propelling the energy transition to renewables and the multi-decade investment opportunity they present.

A key milestone for renewables

A recent BBC news report is an indicator of both good and sombre news in the ongoing fight against climate change and greenhouse gas emissions. The good news: for the first time, renewable sources (wind & solar) of energy accounted for more than 10% of the total global electricity generated. This is a major milestone for wind and solar, the two fastest growing sources of renewables that are likely to lead the transition away from fossil fuels. The sombre news: the report highlights the limited progress achieved despite many decades of effort and the long list of challenges in transforming the energy mix currently leaning heavily on fossil fuels. Renewables require massive investments, and strong support from governments and regulators. It may take a while before the scales tilt in favour of renewables.

Source: www.bbc.com/news/science-environment-60917445

Wind and solar generated a tenth of global electricity for the first time

Source: Ember’s Global Electricity Review 2022; https://ember-climate.org/insights/research/global-electricity-review-2022/

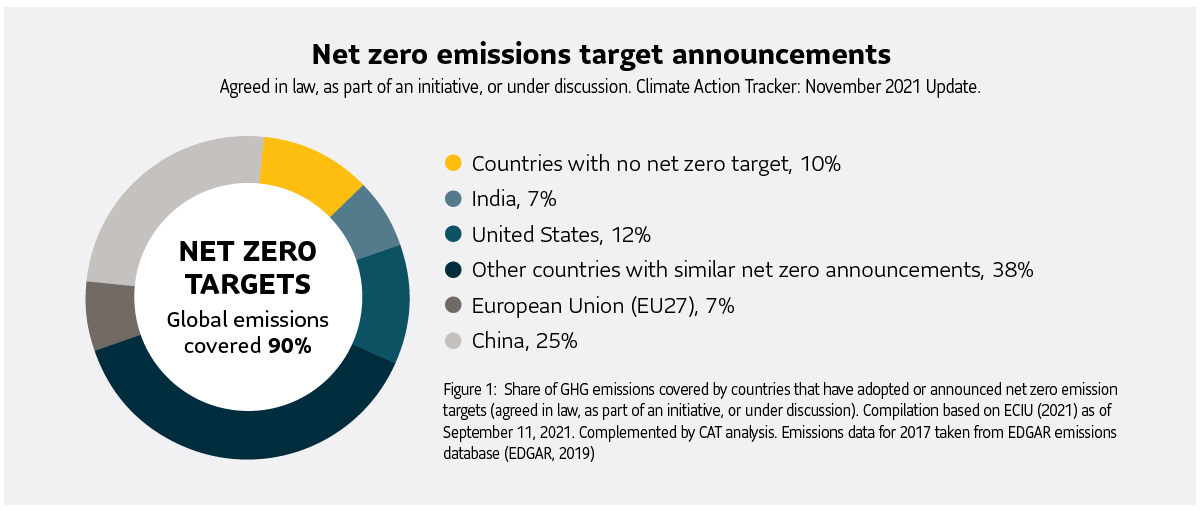

The Net Zero initiative

Many of us have heard the term ‘net zero’, but what exactly does it signify? In simple terms, net zero refers to the balance between the amount of greenhouse gases produced and the amount removed from the atmosphere. We reach net zero when the amount of greenhouse gases we add is no more than the amount taken away*.

At the UN Climate Change Conference in 2015, the Paris Agreement was reached to move towards carbon neutrality by the second half of the 21st Century (2050), to mitigate the effects of climate change. The recently held COP26 summit again highlighted the commitment to net zero and the challenges as emerging markets like China and India negotiated for the timeline. As of 2 November 2021, over 140 countries had announced or are considering net zero targets, covering 90% of global emissions, compared to the 130 countries, covering about 70% emissions, in May 2021.

Source: https://climateactiontracker.org/global/cat-net-zero-target-evaluations/

*National Grid: https://www.nationalgrid.com/stories/energy-explained/what-is-net-zero

Energy Independence

While Climate change has been a big theme driving policy, energy security has now become the second pillar driving the energy transition in the wake of the Ukraine invasion. European leaders know they must now reduce their reliance on Russian gas, and this will result in faster adoption of wind and solar installations. Wind, solar, storage and green hydrogen will play a key role in ensuring the continent becomes less dependent on Russian gas. Already, European leaders have pledged to reduce Russian gas consumption by two thirds by the end of 2023. We have also seen some responses from both the EU and other countries that indicate accelerated spending on the energy transition. As a result, European companies may benefit from transition in energy strategy. In the past month alone, we have seen the following policy announcements which deepens our conviction in the opportunity.

| REPowerEU plan | is looking to add more LNG, more renewables, energy efficiency/heat pumps. They also plan toaddress permitting which is a key bottleneck in the build out of renewable capacity. |

| Germany | announced an additional €200bn in spending for climate protection over the period to 2026 and brought forward the 100% renewable energy target from 2050 to 2035 and plans to develop hydrogen infrastructure. |

| Netherlands | designated new areas for 10.7 GW of new Offshore Wind – which is doubling the total planned capacity for offshore wind energy to around 21 GW by 2030. |

| UK | is to accelerate the construction of new wind and solar projects as part of a new British Energy Security Strategy that will be published shortly. |

| France | launched 500MW floating wind tender for two new 250MW projects in the Mediterranean Sea. |

| Denmark | launched a DKK1.25bn (€168mn) tender for hydrogen production, which can be used in shipping, aviation, heavy transport, and industry. |

Source: KBI Global Investors

Sun Life KBI Sustainable Infrastructure1

The convergence of these diverse factors can translate into a favourable tailwind for investors looking for a multi-decade investment opportunity. Investors could also benefit from looking beyond popular over-owned sectors such as Technology and Communication Services to diversify into new opportunities. The Sun Life KBI Sustainable Infrastructure may be the answer they need at this moment. The fund can provide investors the following:

- An avenue to invest into new end markets within Renewable Energy

- Participation in the entire value chain and not just one sleeve (power generation)

- Diversification beyond home market and be closer to key markets which benefit the most from the opportunity

- The ability to combat inflation and manage a rising interest rate environment

- A seasoned and experienced team of portfolio managers

Participate in the entire value chain through portfolio allocation to various end markets

Source: KBI Global Investors as of December 2021

1Sun Life KBI Sustainable Infrastructure Segregated Fund is a segregated fund offered by Sun Life Assurance Company of Canada through its Group Retirement Services platform; it invests directly in series I units of the Sun Life KBI Sustainable Infrastructure Private Pool, a mutual fund managed by SLGI Asset Management Inc. Series I securities are only available to certain mutual funds and eligible institutional investors. Commissions and trailing commissions are not payable on Series I securities but management fees and expenses may be associated with these investments. Each Series I investor negotiates its own management and advisory fee that is paid directly to SLGI Asset Management Inc. Please read the prospectus before investing.

Benefits from global diversification by being closer to the action!

The Sun Life KBI Sustainable Infrastructure has the highest weighting to Europe across the three focus areas of sustainable infrastructure in part because the continent has the most ambitious emission reduction targets and the most supportive clean energy policy. The energy transition is a global theme but one which has gained the most traction across European countries.

| Region | Investment % | Category % |

|---|---|---|

| North America | 44.70 | 56.22 |

| United Kingdom | 12.13 | 5.89 |

| Europe Developed | 34.12 | 27.44 |

| Europe Emerging | 0.00 | 0.00 |

| Africa/Middle East | 0.00 | 0.00 |

| Japan | 2.14 | 0.76 |

| Australasia | 0.00 | 5.00 |

| Asia Developed | 0.00 | 0.73 |

| Asia Emerging | 6.91 | 1.72 |

| Latin America | 0.00 | 2.24 |

Investment as of January 31, 2022. Category: Global Infrastructure Equity as of February 28, 2022. Region data based on the rescaled long position of the equity holdings.

Source: Holdings-based calculations. Morningstar.com

To reiterate the investment opportunity, critical infrastructure related to food, water and clean energy are currently undergoing a transition. Sun Life KBI Sustainable Infrastructure is forward-looking, and investing in under-owned infrastructure assets in these three areas. Investing in these firms could mean reaping similar benefits associated with investing in traditional infrastructure firms – monopolistic advantages that come with regulatory support, long term contractual business, low volatility of earnings, quality of assets and management, stable and predictable cash flow. Such companies also help the fund deliver long-term capital appreciation and inflation protection while also generating income.

For more information please contact your Sun Life Global Investments Institutional Business Development and Client Relationship representative or: Visit slgiinstitutional.com/sustainableinfrastructure

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset

Management Inc. or sub-advised by KBI Global Investors (North America) Ltd. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. This commentary is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Information contained in this commentary has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

This commentary may contain forward-looking statements about the economy and markets, their future performance, strategies or prospects or events and are subject to uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.