Finding income in an evolving yield environment

This combination: inflation and uncertainty around rising interest rates, is making it difficult to invest for income. In this article, we’ll look at how we’re addressing these challenges by broadening out our sources of returns, and why bonds should still be a key part of portfolios.

*Source Statistics Canada, January 1, 2021

Bonds: still a core building block in portfolios

Fixed income securities are important building blocks in a diversified portfolio, providing four key benefits:

- Capital preservation: Higher-quality fixed income securities, issued by entities such as governments, corporations and financial institutions are an important source of potential capital preservation and security.

- Income: The coupon (interest payments) is a critical source of income, historically providing most of the returns on bonds. And these coupons provide a buffer, potentially preserving capital when interest rates rise.

- Liquidity: Deep secondary markets exist for fixed income securities. This allows investors to quickly liquidate or rebalance portfolios.

- Diversification: Higher-quality fixed income returns generally have had low correlations with riskier asset classes. This diversification may help smooth out portfolio returns.

Looking beyond government bonds for enhanced returns

Given the evolving market conditions, it can be challenging to generate income, find liquidity and preserve real (inflation adjusted) capital over longer periods. In fact, Canada’s broad fixed income market generates an average annual yield of around 1.9%*. This is just below the 2% mid-point of the Bank of Canada’s target inflation range of 1% to 3%.

*Source: FTSE. Data: December 31, 2021

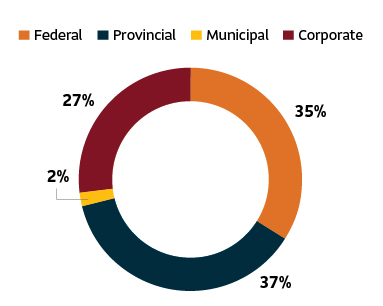

Within Canada’s fixed income market there is a strong bias towards high-quality, lower-yielding government issues. But Canada’s corporate bond market is much smaller. This results in fewer options to derive longer-term returns and income generation domestically from this traditional core building block.

Given this, broadening out the source of returns can play an important role in potentially enhancing returns. To do this, we focus on:

- Building a strong foundation in core Canadian bonds.

- Investing in a wide range of complementary sources of returns. Including in varying interest rates, countries, currencies, corporate bonds, and liquidities. This broader approach within Canada and globally helps us strive for reasonably consistent, excess returns over Canadian bonds.

- Using a flexible multi-manager structure that evolves with changing market conditions –tactically over the shorter term, and strategically over longer periods.