Watch Portfolio Manager Christine Tan provide a Q3 Market Update in our latest video.

Highlights

- Major indexes continued to rally

- Oil prices climbed from US$73.47 a barrel to US$75.03

- Canadian dollar slipped from US$080.68 to US$078.87

- After spiking in March, yield on U.S. 10-year Treasuries retreated to 1.30%

- U.S. Federal Reserve signalled that interest rates could rise in 2022

- Prime Minister Justin Trudeau won a second minority government

- The European Central Bank, citing inflation worries, started to reduce its quantitative easing program

Markets rallied throughout the spring and summer, with the S&P 500 ending August up 20% year to date. There was little standing in the way: key interest rates remain effectively at zero, more fiscal stimulus was expected in the U.S. and earnings growth remained solid. But in the final weeks of Q3, cracks were starting to show. Economic growth, hampered by the Delta variant slowed, potentially eroding corporate profits. Inflation was running at its highest rate in years; valuations were stretched and internecine political battles in Washington may scuttle hopes for further stimulus. With all that weighing on the market, the S&P 500 ended September down 4.8% - its worst monthly performance since the market hit bottom in March 2020.

Overriding all these concerns, was the question of when the U.S. Federal Reserve would begin raising interest rates. And the market got at least part of the answer to that question shortly after quarter end, when the minutes of the Fed’s September meeting were released. They suggested that the Fed could begin tapering its US150-billion-a-month, bond-buying program in mid-November. This could potentially lift interest rates on longer-dated debt.

Fed officials though stressed that if they move ahead with tapering, it does not imply that the Fed is about to hike its key policy rate, now sitting at effectively zero. Still, with inflation running at 5.4 % in September, a 13-year high, there appears to have been a change of sentiment, with the first interest rate hikes possibly coming in the fall of 2022

In 2013, as the economy recovered from the financial crisis, the market had a “taper tantrum” and sold off briefly when the Fed announced it was about to taper. This time the market appeared to have anticipated the Fed’s decision and instead climbed higher on positive earnings news.

Our own view is that interest rates will move slowly higher. Indeed, a number of senior Fed policymakers expect the Fed’s key interest rate to rise to at least 1% by the end of 2023, reflecting a growing consensus that higher rates might be needed to keep inflation in check.

Moving to neutral – waiting for a market catalyst

All these risks have backed into our risk/return equation. As such, over the course of the third quarter we reduced our equity exposure in the Sun Life Granite Solutions to neutral.

However, while we expect ongoing interest rate and pandemic concerns to hinder the market, the outlook could improve toward year-end. For one, the massive amount of fiscal stimulus (estimated at US$20 trillion worldwide) continues to support economic growth. And we could yet see a Congressional agreement on the passage of a $US1 trillion infrastructure bill. However, a separate $3 trillion budget bill, may be reduced, if it passes at all.

On the monetary policy side, even if the Fed were to begin tapering tomorrow, it would be a gradual process. Moreover, even if interest rates rose to 1% in 2023, as some members of the Fed predict, rates would still be near historic lows. And for now, with real bond yields essentially negative, equity markets may continue to attract investors looking for an alternative.

In terms of inflation, we tend to agree with Powell’s view that the spike we’ve seen in inflation could be temporary. The Fed chair believes inflation is in part caused by disruption in supply chains, not consumer demand. In fact, the ports of Los Angeles and Long Beach, which normally move 40% of containers in U.S., had 62 cargo ships waiting to dock in late September. However, as bottlenecks like these are resolved, it should help ease the upward pressure on prices, with the Fed believing inflation will fall back to the 2% range.

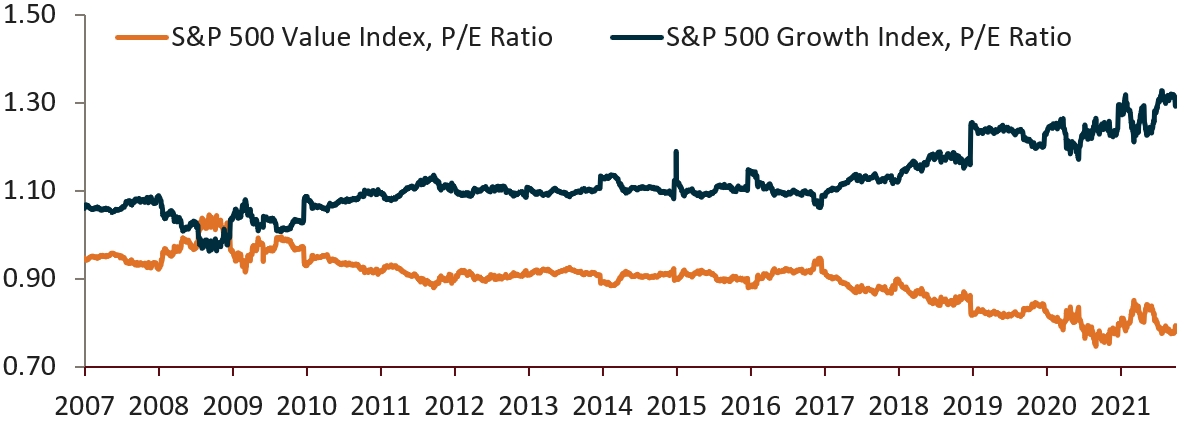

As the economy picks up speed, as we expect it will, value and cyclical stocks could outperform growth stocks again (Chart1). Initially, in September 2020, to take advantage of the reopening trade, we reduced our exposure to growth stocks and started to overweight value stocks and cyclicals through a value factor ETF in the Sun Life Granite Tactical Completion Fund.

However, the rally in value and cyclicals paused in the spring and summer, as the economy slowed, interest rates retreated, and growth stocks outpaced value. We now, expect the economy to rebound again as we move past the COV19 Delta variant. As such, we are positioning the portfolios for a rotation back to U.S. value and cyclical stocks. In addition, our largest equity overweight is now in global mid-caps, giving us broad exposure to cyclicals and value as the global economy recovers.

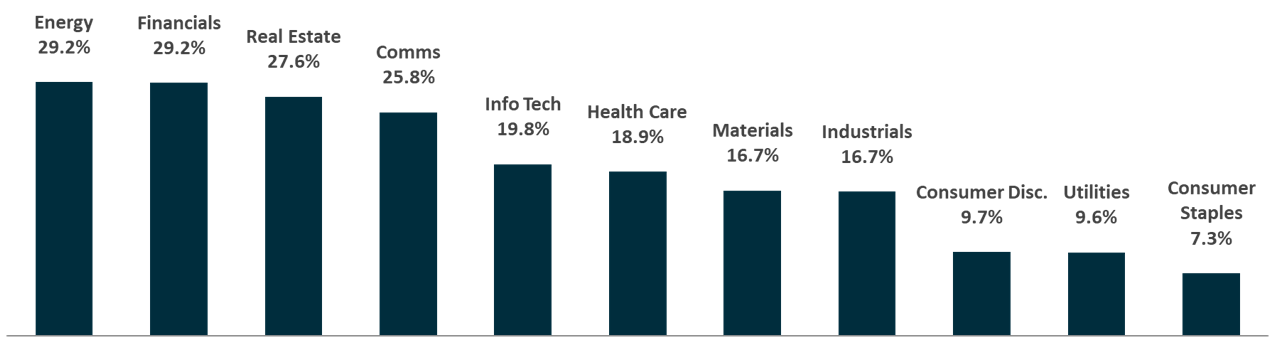

So far this year, energy and financials have been the two top- performing sectors. We have overweight exposure to financials as well as industrials as potential beneficiaries of the continued economic reopening. We also added an opportunistic position in airlines as global travel gradually resumes with higher levels of vaccinations.

Despite the sell-off in the interest-rate-sensitive technology sector at quarter end, we continued to hold high-quality names in the group. The tech sector did selloff in September, when the yield on 10-year Treasuries started climbing again. At one point hitting 1.56%, its highest point since June, with investors concerned about inflationary pressures and tighter monetary policy. However, given the earnings power of the tech titans, led by the so-called FAANG stocks, we expect these quality names to recover. Hence, we largely maintained our weighting in growth.

As U.S. equities continued to push higher through most of Q3, we also purchased put options to hedge the downside risk in the portfolios. As markets sold off in mid-September, we took profits on these hedges.

Chart 1: Will value outperform growth?

Bloomberg. Data as of September 29, 2021.

Bloomberg. Data as of September 29, 2021.

Fixed income: Prefer cash to bonds

In Q3, we continued to favour cash over bonds. We believe there could be a pickup in growth in Q4 along with rising inflation expectations. If so, it could push yields higher and lower bond prices. Given this, we continued to be underweight duration sensitive issues.

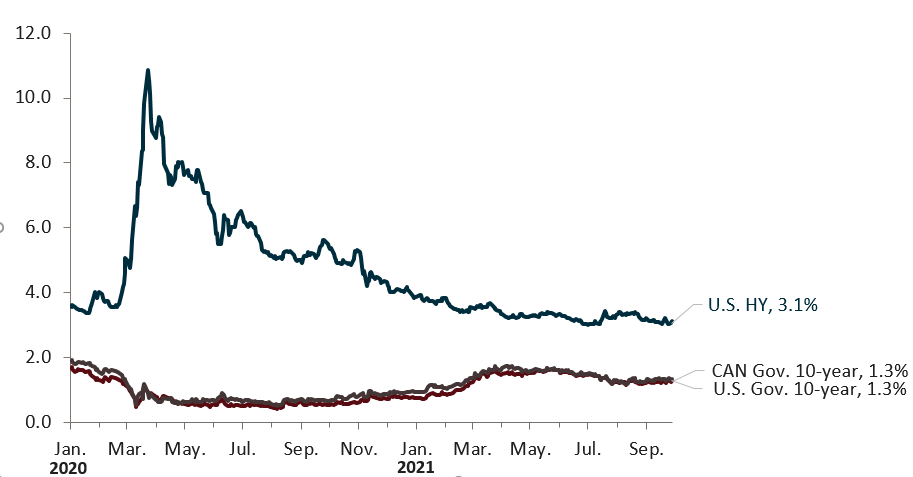

Alternatively, we remained overweight high yield corporate bonds, with a specific allocation to intermediate-term corporates (Chart 2).

Chart 2: High yield bonds outperform

Bloomberg. Data as of September 29, 2021.

Bloomberg. Data as of September 29, 2021.

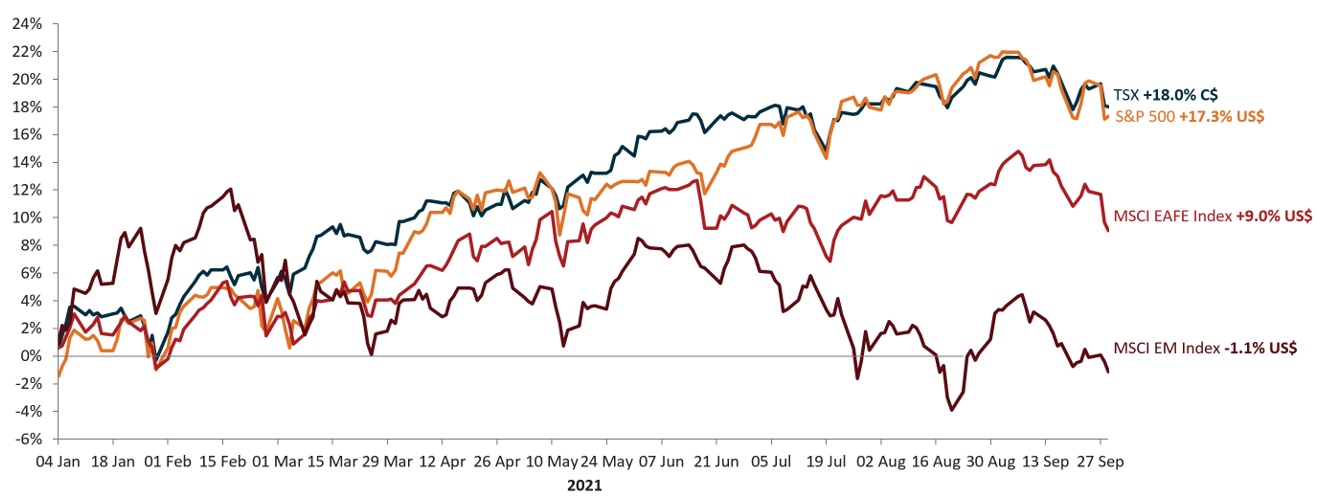

After a 17-month-long rally off the March 2020 bottom, most major equity indices were up on the year at quarter end (Chart 3).The S&P 500 was up 17.3%, and the S&P/TSX Composite Index was up 18%, led by energy and financials (Chart 4). While we believe the S&P 500 could still move higher in the fourth quarter, as noted, the current rally appears to be over extended.

Chart 3: Equity markets move higher

Bloomberg. Data as of September 30, 2021.

Bloomberg. Data as of September 30, 2021.

After extended run, neutral on the U.S.

With risks growing in the market, we dialed back our U.S. equity overweight to neutral in Q3, from 1% in Q2. Even though we reduced our equity exposure, we still believe the U.S. economy is well positioned. The Conference Board forecasts that U.S. real GDP growth will slow to 5.5% (annualized rate) in Q3, versus 6.6% in Q2. It expects the economy to grow by 5.9% this year.

Despite this, consumer confidence slipped in the quarter amid rising concerns about the rapidly spreading Delta variant. As well, consumer spending may also have been further dampened by rising inflation. Still, U.S. consumers are sitting on US$26 trillion in excess savings (about 12% of U.S. GDP), which could ultimately find its way into the economy, stimulating further growth.

Moreover, as noted, even if the Fed starts to taper it will still be supplying monetary stimulus for months to come. More fiscal stimulus may also be on the way as a US$1 trillion bi-partisan infrastructure renewal bill makes its way through Congress. But the Democrat Party’s progressive wing has linked passage of the bill to a broader US$3 trillion spending plan, which has divided the party and raised doubts about its passage.

With the economy expanding, there are 10.5 million job openings in the U.S., while nearly 8.5 million people remain unemployed. However, many COVID-19 related income subsidies ended in September, leading to the possibility that many people may return to the workforce.

Canada: neutral but positive on the economy

We continued to be neutral on Canadian equities in Q3. However, while the economy did contract in the second quarter, we remain positive. Indeed, even though slowing, the economy had grown by 5.1% on the year at the end of Q2 in nominal terms above its pre-recession peak – the best performance in the G7.

Personal finances also continued to improve, with household income rising in the quarter. Canadian consumers are also well positioned to go on a spending spree when the economy fully opens. In fact, Statistics Canada calculates that Canadians amassed $212 billion last year in savings, versus $18 billion in 2019. That works out to $5,574 per Canadian on average in 2020, compared to just $479 in the previous year.

While supply chain disruptions pose a risk to the economy, it continues to benefit from a strong housing market and the surging demand for commodities, including oil, natural gas and base metals like copper. Natural gas has almost doubled in price, and oil has more doubled. As well, if interest rates trend higher, as we suspect they may, we could see further gains in the Canadian financial sector.

Chart 4: Energy leads S&PTSX/Composite higher

Source: Macrobond. Data as of September 29, 2021.

Source: Macrobond. Data as of September 29, 2021.

China’s slowdown clouds EM growth

Throughout the market rally this year, we maintained an overweight to emerging markets (EM). However, we have moved to neutral, with the risk/reward equation balanced. On one side we have attractive valuations while on the other, we’ve seen a modest tightening in monetary policy with minimal fiscal stimulus to offset the impact of COVID-19 and pockets of uncertainty in China.

The economy has also had to absorb sweeping regulatory changes. For one, President Xi Jinping’s “common prosperity” initiative has led to a clamp down on a broad number of sectors. At one point, it’s estimated that Xi’s campaign erased $1 trillion from the market value of the country’s largest companies. As well, there was a slowdown in property sales and construction activity in the wake of the debt crisis facing real-estate giant Evergrande.

China’s slowdown may also spill over into other economies in the region. More broadly, with the Fed moving closer to raising interest rates, the U.S. dollar has firmed. While this would help EM countries exporting products priced in U.S. dollars, it would hurt more import-dependent economies.

Europe: improving but trailing the U.S. recovery

We have a neutral allocation to global equities overall, with our 1.8% underweight in large-cap international equities fully offset by a 2% overweight to global mid-caps.

Within that global allocation, we have exposure to Europe. Positive catalysts include accelerating vaccination rates. And allocations from the 2021-2027 European Recovery Plan are now being deployed.

However, the European Union (especially Germany) has a significant trade exposure to China. So any near-term softening in China’s economic activity (resulting from the Evergrande debt crisis and regulatory over haul) could be a head wind.

The current energy shortage in Europe could also moderate industrial activity, especially as we head into winter when energy demand for heating picks up. Overall, while valuations are attractive and Europe is home to more cyclical businesses that should benefit from the continuing global reopening, there are headwinds that keep us neutral on global equities overall.

Outlook: reducing our equity overweight

Overall, we reduced our equity weighting to neutral from a slightly overweight position.

- Reduced our overweight position in U.S. equities to neutral; added exposure to U.S. value and cyclicals stocks.

- Continued to hold a neutral weighting on Canada.

- Neutral on global equities overall, with a preference for smaller companies

- Moved from an overweight to a neutral weighting in emerging market equites.

- Preferring cash over bonds with a slight overweight position in high yield corporate bonds.

We will continue to manage risk in the short term while looking for longer-term opportunities. However, for now, we are comfortable with how the Sun Life Granite series of funds are positioned.