Source: Bloomberg. Data as of June 30, 2024.

We are concerned about economic growth prospects outside the U.S. Government spending has been an extra boost for U.S. growth, but an absence of such fiscal generosity in other economies is already showing. Many developed economies are wrestling with a more acute manufacturing slowdown than the U.S. Other sources of growth such as consumption and exports are also under pressure outside of the U.S. In response, major central banks such as the European Central Bank and the Bank of Canada have already initiated interest rate cuts to loosen monetary conditions.

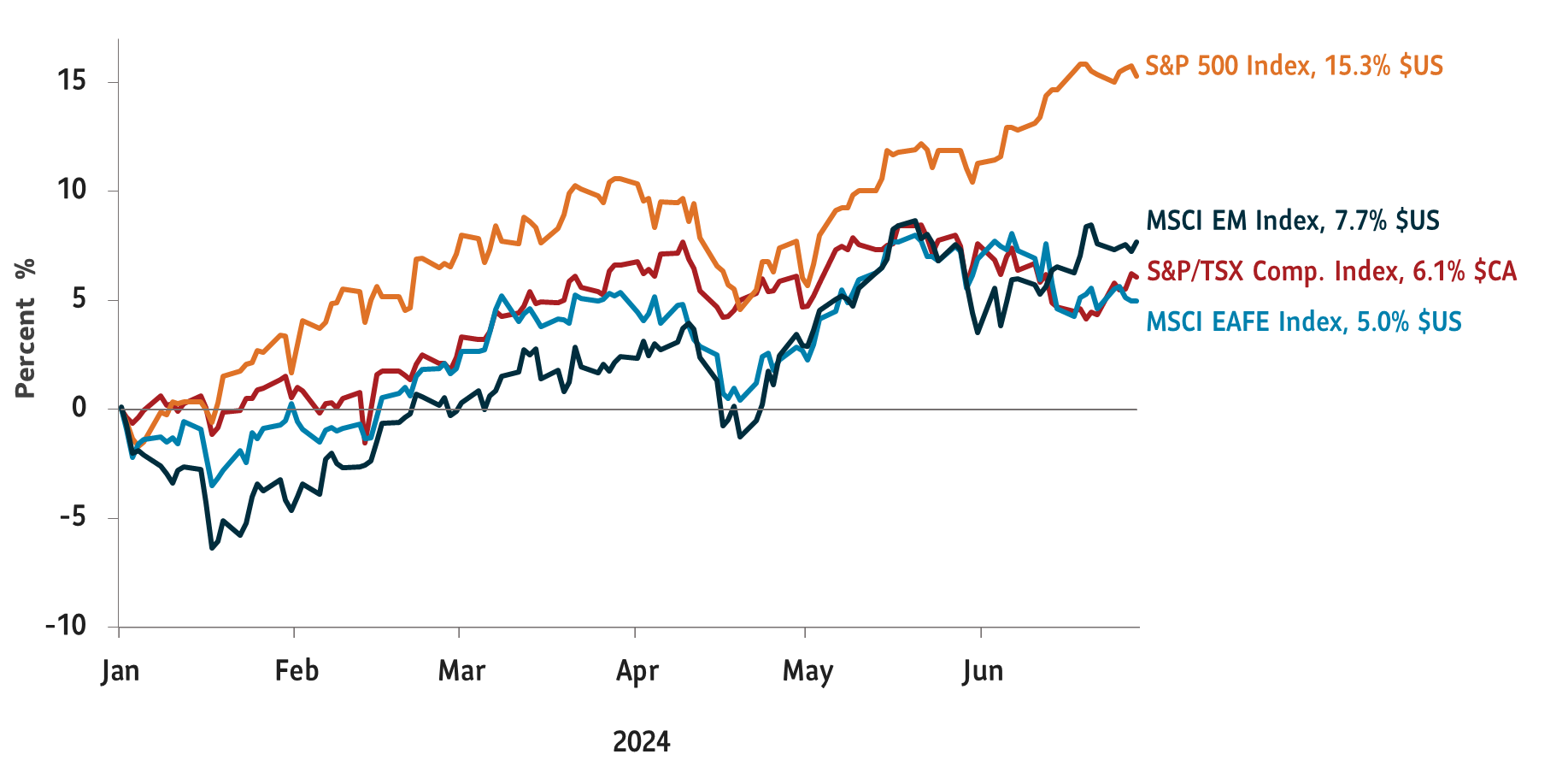

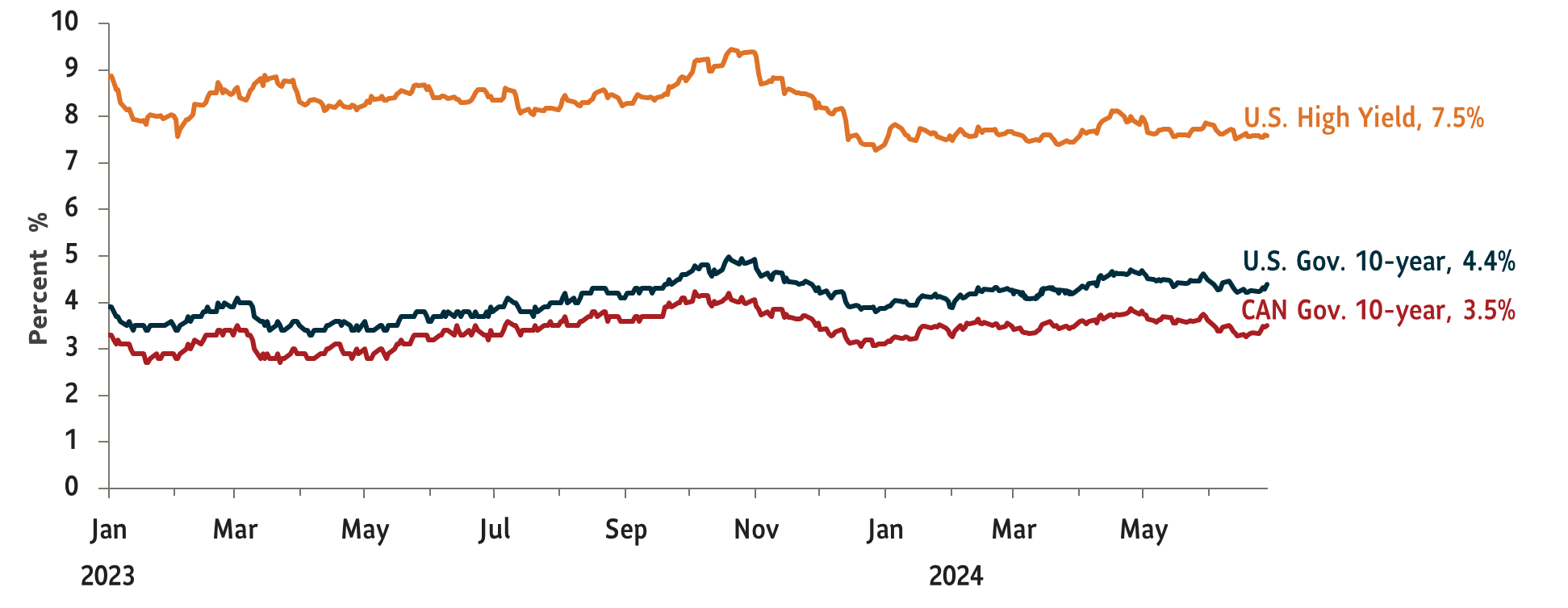

Given these conditions and geopolitical risks, we are largely neutral to equities across regions. In the U.S., we are concerned about the concentration of gains in the technology sector, where a handful of stocks have largely driven market returns. We also worry about the rich valuations of U.S. equities relative to their profit outlook. On the other hand, we think the equity rally may broaden out to sectors that have mostly been stagnant for many quarters. We think a Fed rate cut may give a much-needed boost to these sectors. We also reduced our bets on emerging market equities as our data shows rising growth concerns. Within fixed income, we think core credit dominated by government issuers offer more value over risky credit such as high-yield that are trading at tighter spreads. We are modestly overweight cash as we look for opportunities to deploy in both equity and fixed income markets.

Views expressed regarding a particular company, security, industry, or market sector should not be considered an indication of trading intent of any investment funds managed by SLGI Asset Management Inc. These views are subject to change at any time and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. This commentary is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Information contained in this commentary has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

This commentary may contain forward-looking statements about the economy and markets, their future performance, strategies or prospects or events and are subject to uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds, Sun Life Granite Managed Solutions and Sun Life Private Investment Pools.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.