Climate change affects us all

The warming of the planet affects us all, but the impact is not always observable or uniformly distributed. However, there are solutions that will allow us to build cleaner, more resilient economies.

Time to work together towards a solution

From wildfires, flooding, and rising sea levels to green infrastructure. All these are linked by a common thread – climate change. The warming of the planet affects us all, but the impact is not always observable or uniformly distributed. In fact, climate change can be a social issue, lying at the nexus of a multitude of environmental factors. And many of those come with a financial cost, impacting individuals, communities, governments and the private sector across the world.

Mankind advanced, CO2 emissions increased – the planet warmed

The increase in the average global temperature has largely been caused by steadily rising, human-induced greenhouse gas emissions. Of these, carbon dioxide makes up the bulk of emissions. But smaller amounts of other greenhouse gases, including methane and nitrous oxide, are also emitted and highly impactful. In turn, all these gases help trap the sun’s heat in the atmosphere, causing temperatures to rise over time.

The rapid, steady warming of the planet can be traced to the start of the Industrial Revolution in the 1880s. Since then, the earth’s temperature has risen by 0.08°C every decade. Moreover, the rate of warming over the past 40 years has accelerated to more than twice that, to 0.18° C a decade since 19811.

There is now a growing urgency to slow global warming by rapidly reducing emissions. To that end, the United Nation’s Intergovernmental Panel on Climate Change (IPCC), has issued increasingly dire warnings that if something is not done to curb emissions, temperatures will rise to dangerously high levels2. If that happens, IPCC believes the economic and social damage caused will continue to rise, including increased poverty and greater food insecurity, beginning in vulnerable regions.

Although progress on climate action has been slow and uneven, the world is increasingly paying attention. And under the terms of the Paris Climate Agreement signed in 2015, 196 parties agreed to strive to hold the planet's warming to well below 2°C, and preferably to 1.5°C, by the end of the century.

Climate change – an existential threat?

Human evolution has been subject to significant changes in the average surface temperature going back between six to eight million years. However, the rise of civilization has benefitted from a reasonably stable climate, allowing for growth in energy, agriculture, heating, cooling and much more.

Do we now face an existential crisis in climate change? If left unchecked, some scientists say we do. Certainly, as the IPCC makes clear, it affects people across all regions, sectors, and organizations – albeit in various degrees.

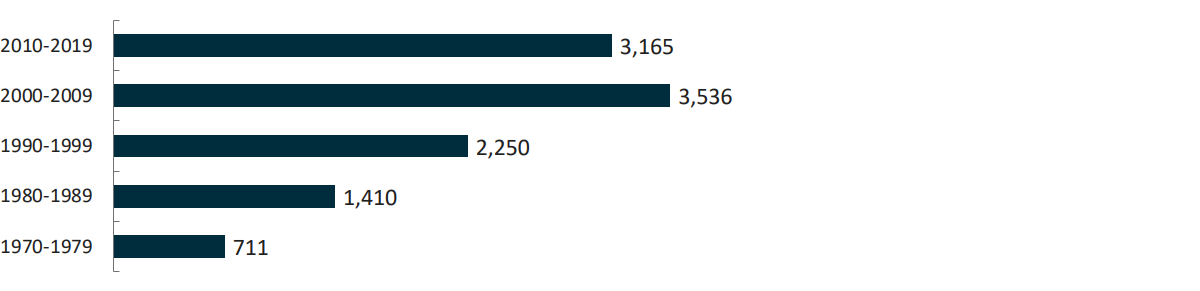

But even as we attempt to slow the pace of warming, its effects are already increasing across the globe (Chart 1). This was apparent in British Columbia in the early summer and fall of 2021. Initially, southern B.C. was trapped under a heat dome. This occurs when hot ocean air sits over an area for days. And temperatures climbed as high as 49.6°C (121.3°F) – the hottest ever recorded in Canada3. Then in November, B.C. was hit by a series of atmospheric rivers, causing historic flooding. These weather anomalies carry columns of water vapour roughly equivalent to the average flow of water at the mouth of the Mississippi River. Roads, bridges, and railways were washed away. Farm fields were left under two metres of water. In the end, the B.C. flood caused $550 million in damage.

Chart 1: Number of recorded disasters

Source: UN Meteorological Organization 2021 Report, https://www.bbc.com/news/science-environment-58396975

But climate change does more than damage communities and organizations. It can also affect our health and wellbeing. Again, using the B.C. example, the provincial coroner’s office reported that 595 people died as a direct result of the heat wave. Less discernible, is the impact of all this on mental health, an issue increasingly garnering attention.

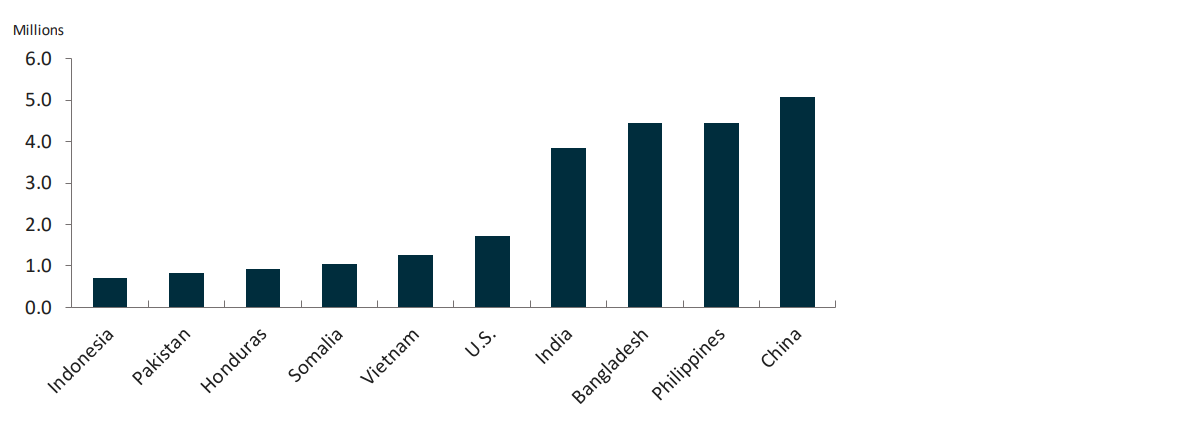

Climate change, according to the United Nations Environment Programme (UNEP), has also aggravated social disparity, putting the poorest communities and women at greater risk (Chart 2). In fact, between 2010 and 2020, droughts, floods, and storms killed 15 times as many people in highly vulnerable countries, including in Africa and Asia, then in the wealthiest nations4. Similarly, the Canadian Institute for Climate Choices notes that in terms of health costs, many people are more vulnerable because of age, or face greater risks due to economic disadvantages, racism, or discrimination.

Chart 2: People displaced by climate in 2020 (millions)

Source: Internal Displacement Monitoring Centre, showing top 10, https://www.internal-displacement.org/sites/default/files/publications/documents/grid2021_idmc.pdf

Climate change is also affecting corporations and governments directly. As we saw in B.C., extreme weather events (wildfires, droughts, and floods) have a direct impact on infrastructure, livelihoods, soil quality and biodiversity. Indeed, as noted, the estimated cost of the flood damage alone in B.C. was around $550 million. But B.C. is just a snapshot of the larger global picture. For one, Munich Re, a global German reinsurer, estimates that overall losses caused by natural disasters reached US$280 billion in 2021. This is compared to US$210 billion in 2020 and US$166 billion in 20195.

According to Munich Re, US$120 billion of 2021's losses were insured6. This last point illustrates two problems. On one side, individuals and governments increasingly may have to shoulder the cost of uninsured losses. And others could face higher costs as insurance premiums rise. In fact, Swiss Re, another global reinsurer, predicts that the growing frequency and severity of extreme weather events will trigger a 22% increase of property premiums globally over the next 20 years. This will add US$183 billion in additional insurance costs7.

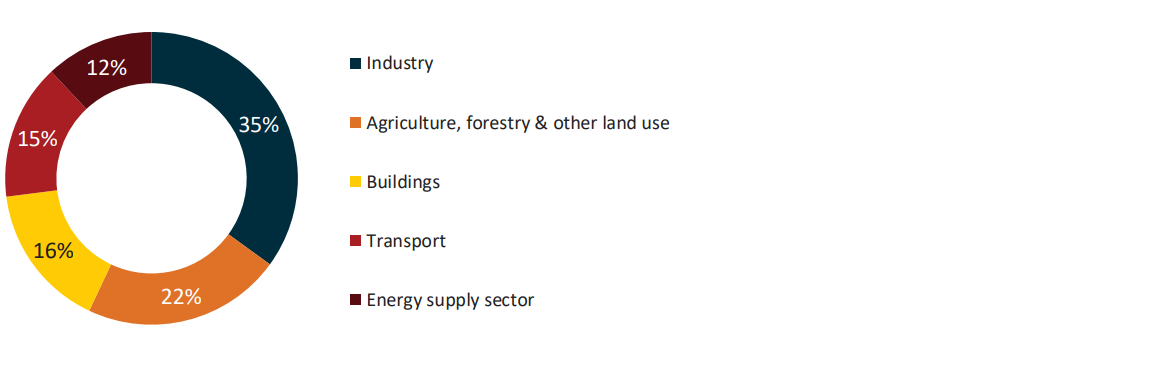

As we shift to a low-carbon environment, few sections of the economy will remain untouched (Chart 3). This may bring transition risks, both socially and economically. How, for example, will workers in carbon-intensive industries that are downsizing be retained or supported? There will also be broad public policy changes resulting in new climate-related regulations, pricing mechanisms, and incentives. And these will influence economic assessments in a number of areas, including profitability, asset values, cost of capital and allocation of capital.

Chart 3: Balancing the cost of fighting climate change

The inherent costs will add up. In fact, The Energy Transitions Commission (ETC), a coalition of senior executives from 45 energy producers, financial institutions, and environmental groups, estimates that it may cost upwards of US$2 trillion a year for countries worldwide to reach carbon neutral goals by 20508. That would represent about 1.5% of global GDP by the middle of the century.

But what are the costs of not containing global warming? The International Renewable Energy Agency argues that if steps are taken to reduce emissions, climate-related savings could potentially add up to US$160 trillion over the next 30 years9. Put another way, the ETC calculates that global warming has already cost both the U.S. and European Union US$4 trillion in lost economic output. As well, it maintains that tropical countries are 5% poorer (in terms of GDP) than they would have been if not for global warming.

Investment opportunities – the other side of risk

Building a low-carbon future may lead to a massive transformation of the economy. This could change the way energy is produced, distributed, and consumed. As this happens, it may also translate into potential opportunities. But that does not mean our current energy system, and those working within it, will be left behind.

On the contrary, our energy and resource sectors are technologically advanced and have the resources to lead the green transition and be an important part of the low-carbon economy. In short, they offer scale, technological knowledge, and diverse skillsets. For example, Suncor, a major oil sands producer and refiner, is proposing to develop hydrogen technology as part of its sustainability strategy10.

Of course, the move to low-carbon future isn’t just about transforming the energy sector. Indeed, as the IPCC notes: “Preparing for future threats, like dwindling freshwater supplies or irreversible ecosystem damage, will require transformational changes that involve rethinking how people build homes, grow food, produce energy and protect nature.”

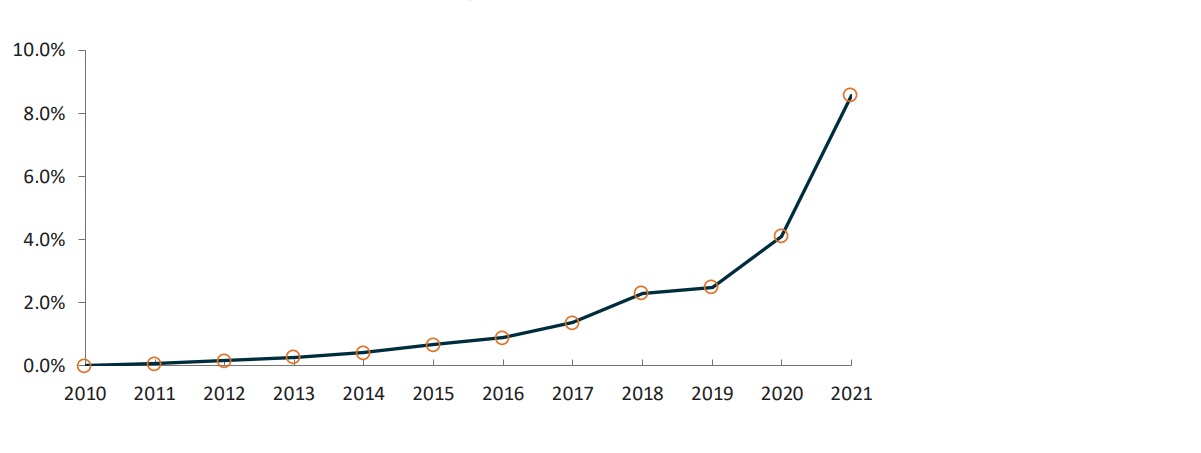

Thus, investment opportunities may arise from those involved in areas like climate change mitigation and sustainability. Certainly, the manufacturing of electric vehicles is illustrative (Chart 4). In 2020, 23 publicly traded companies produced electric cars, with 10 million on the road. That number, according to Bloomberg, is expected to reach 266 million by 204011. Electric vehicles are projected to achieve a market share of 30% by 2030, according to the International Energy Agency (IEA)12.

Chart 4: Electric vehicle's global sales market share

Climate change – a race we could win

As we’ve shown here, climate change will touch every aspect of the economy. Globally, and particularly in more vulnerable countries, it could also put more lives at risk. As noted, without action, the world’s average surface temperature could increase by 3°C this century— with some areas of the world expected to heat even more. However, there are solutions that will allow us to build cleaner, more resilient economies. And fortunately, in the battle against rising temperatures, more people are turning to renewable energy and a range of other measures that will reduce emissions and increase adaptation efforts. We all need to do our part, as individuals, and collectively. That is why Sun Life Global Investments signed on to the Net Zero Asset Managers initiative, supporting the goal of net zero greenhouse gas emissions by 2050 or sooner.

Learn about our climate action commitment

Integrating ESG factors (including climate risk) into our portfolios

Momentum continues to grow across the globe to prioritize sustainability and mitigate climate change, and investors across the world are also embracing this view.

At Sun Life Global Investments, we believe one way to further sustainability is through ESG integration, and engagement with our sub-advisors. As part of our due diligence, we assess and monitor our sub-advisors on how they integrate ESG considerations into their investment process, and we engage with them to influence stronger alignment with ESG factors in their portfolios. Climate change is one important area we assess as part of this process.

Learn more about how we integrate ESG factors into our portfolios

1 Source : https://www.climate.gov/news-features/understanding-climate/climate-change-global-temperature

2 Source : https://www.genevaenvironmentnetwork.org/events/briefing-on-the-ipcc-climate-change-2022-report-mitigation-of-climate-change/

3 Source: https://www.carbonbrief.org/media-reaction-pacific-north-west-heat-dome-and-the-role-of-climate-change/

4 Source: https://www.wri.org/insights/ipcc-report-2022-climate-impacts-adaptation-vulnerability

5 Source: https://www.munichre.com/en/company/media-relations/media-information-and-corporate-news/media-information/2022/natural-disaster-losses-2021.html

6 Source: https://www.munichre.com/en/company/media-relations/media-information-and-corporate-news/media-information/2022/natural-disaster-losses-2021.html

7 Source: https://www.swissre.com/risk-knowledge/building-societal-resilience/growing-risk-insurance-industry-crucial-role.html

8 Source: https://www.reuters.com/article/energy-transition-int/global-net-zero-emissions-goal-would-require-1-2-trillion-a-year-investment-study-idUSKBN2671T6

9 Source: https://www.irena.org/publications/2019/Apr/Global-energy-transformation-A-roadmap-to-2050-2019Edition

10 Source: https://www.suncor.com/en-ca/news-and-stories/our-stories/hydrogen-technology-shows-one-way-to-a-clean-energy-future

11 Source: https://www.thecarconnection.com/news/1111573_opec-thinks-the-electric-car-revolution-is-upon-us-too

12 Source: https://www.iea.org/reports/electric-vehicles