U.S. election insights

History shows that markets do favour a divided U.S. government as a way to moderate any extreme policy tilts or spending plans.

History shows that markets do favour a divided U.S. government as a way to moderate any extreme policy tilts or spending plans.

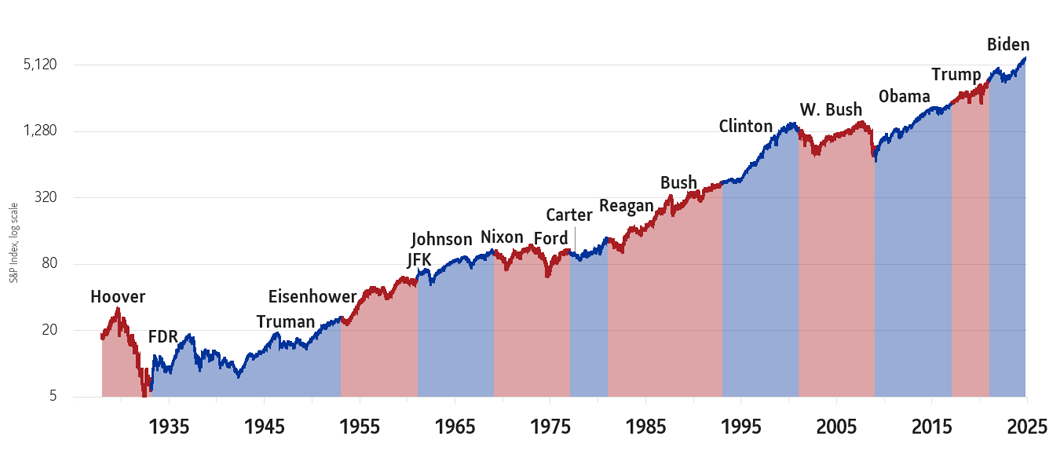

We may not find out today who wins the 2024 U.S. Presidential election race. The uncertainty of what may happen and ongoing volatility continues to weigh on the minds of many investors, but overall history shows that markets are pretty much indifferent to whichever party takes the presidency. However, markets do favour a divided government as a way to moderate any extreme policy tilts or spending plans.

Top takeaways

Average market performance is similar under a Democrat or Republican government

(according to historical S&P 500 data)

A closer look at performance

(S&P 500 price return from 1901 to now*)

S&P 500 return from 1901 to present |

Post-election year |

Mid-term year |

Pre-election year |

Election year |

|---|---|---|---|---|

Democrat average return |

8.2 |

3.7 |

16.2 |

6.9 |

Republican average return |

4.2 |

3.3 |

6.9 |

9.3 |

Source: Macrobond as at Dec. 31, 2023

Also note that there are no consistent sector winners in subsequent years depending on the party that wins the presidency. Despite the political rhetoric, the actual impact of either party on different sectors varies. More meaningful to sector performance is the prevailing economic environment.

Both presidential candidates propose policies that will further raise the deficit

Harris Presidency, Democratic Congress |

Harris Presidency, Republican Congress |

Trump Presidency, Democratic Congress |

Trump Presidency, Republican Congress |

|

|---|---|---|---|---|

Tax Cuts & Jobs Act (TCJA) |

Extend individual tax provisions under $400k |

Extend individual tax provisions under $400k, partial of expiring business provisions |

Extend individual tax under 98th percentile, partial of expiring business provisions |

Fully extend individual and business provisions |

Other Tax |

~$2 trillion in additional tax increases (half corporate, half wealthy & pass through), state and local tax (SALT) relief |

Expand SALT deduction for married filers |

Potentially roll back corporate alternative minimum tax (AMT) |

Repeal corporate AMT and buyback tax |

IRA Clean Energy Subsidies |

No major change |

No major change |

No major legislative change. Admin tightens tax & other regulations |

Repeal two thirds of individual retirement accounts (IRA) credit expansion |

Tariffs |

No major change |

No major change |

Sub-60% tariff on Chinese goods. One off tariffs on other trading partners |

Sub-60% tariff on Chinese goods. One off tariffs on other trading partners |

Mandatory Spending |

~$2 trillion safety net increase (education, health care, housing, income support) |

Modest increase in refundability of the Child Tax Credit (CTC) |

Modest increase in refundability of CTC |

Potentially modest cuts for Supplemental Nutrition Assistance Program, Medicaid, student loan supports |

Discretionary spending |

Domestic up more than defense |

Defense and non-defense up the same |

Defense and non-defense up the same |

Defense up more than domestic |

Source: Piper Sandler. (Table meant to convey main potential policies but not an exhaustive or definitive list)

Canada’s trade policy may feel the impact of the election outcome.

Expectations are for a divided government, which might limit broad import tariffs. However, a sitting president will have the power to impose tariffs on imports that are deemed a threat to national security. Such tariffs don’t have to be ratified by the U.S. Congress. The potential outcomes below are based on the same party winning both the U.S. presidency and the U.S. Congress. It also assumes campaign rhetoric will become policy.

|

Harris presidency, Democratic Congress |

Trump presidency, Republican Congress |

|---|---|---|

United States-Mexico-Canada Agreement (USMCA) |

Review in 2026 – likely status quo on trade; potential for more environmental measures |

Review in 2026 – likely adjustment on trade terms since U.S.-Canada trade deficit has widened since agreement |

Trade tariffs |

Status quo of targeted measures; against broad tariffs |

Broad import tariffs up to 20% that don’t currently exclude Canada but possible exception due to USMCA |

Inflation |

Minimal change from expected trajectory |

Broad import tariffs may be inflationary in the U.S., which could also impact Canada |

Economic growth |

Minimal change from expected trajectory |

Additional tariffs or adjustment to USMCA could be headwind(s) for the Canadian economy |

Source: SLGI Asset Management Inc.

All this to say that investors should, as much as possible, avoid listening to the short-term noise and instead focus on their long-term investing goals. For more information, speak to your advisor.

This article is published by SLGI Asset Management Inc. and contains information in summary form. This article is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are subject to change and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. Information contained in this article has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.