In a new whitepaper, we explore Target Date Fund (TDF) design considerations for plan sponsors in a changing investment environment.

- COVID-19 is a stark reminder that designing Capital Accumulation Plan (CAP) portfolios is not easy.

- The Canadian market for CAPs is growing as workplace demographics shift. As TDFs become the default choice for more CAP members, they are likely to play a growing role in the retirement prospects of millions of Canadians.

- As the Canadian CAP market continues to grow in size, it faces new pressures in meeting the savings needs of plan members.

- TDFs have grown from 7% of CAP assets in 2010 to 29% at the end of 2018. More than 35% of all contributions go to TDFs.

Read the whitepaper introduction:

Capital Accumulation Plan (CAP) investment managers around the world are growing in scale and adding capabilities. For the first time, Defined Contribution (DC) pension assets in the largest pension markets (Australia, Canada, Japan, Netherlands, Switzerland, U.K. and U.S)1 have in aggregate caught up in size to Defined Benefit (DB) pension assets. Over the past 10 years, the rate of growth in DC assets in these countries has been close to double (8.9%) that of DB assets (4.6%)2. Although DB plans still make up the majority of pension assets in Canada (88%)3, the growth trend is favouring DC plans over DB plans, with a projected compound annual growth rate of 7.8% (vs. 3.7% for DB plans)4.

The Canadian retirement industry has faced numerous challenges in recent years, with steep global financial and economic crises and low interest rates dampening investment returns, while average life-expectancy is increasing. Whereas such risks are borne by plan sponsors for most DB plans, CAP members bear all these risks and are particularly challenged by relatively static CAP design (contribution levels) and a lack of personal savings.

Sign up to receive our new whitepaper, Target Date Funds for Capital Accumulation Plans.

Two recent whitepapers5 published by the World Economic Forum highlight that most individuals are simply not saving enough, estimating the size of the retirement savings gap in Canada to be $3 trillion in 2015, and forecasted to reach $13 trillion by 2050. Given these challenges, all components of CAP, including investments, need to work harder to help plan members close their retirement gap.

As the Canadian CAP market continues to grow in size, CAP plan sponsors are faced with a diverse set of solution providers and an ongoing evolution in investment portfolio design. In this paper, we explore important features that CAP sponsors should consider as they strive to meet the evolving retirement savings needs of plan members in a changing investment environment.

During the completion of this paper, the COVID-19 pandemic was unfolding across the globe. In the first quarter of 2020, the CBOE Volatility Index (the “VIX”), which began the year at 12.5, hit a peak of 82.7 on March 16. Economies were entering a period of profound uncertainty as governments around the globe-instituted measures to limit the virus spread. At the same time, authorities were unleashing unprecedented fiscal and monetary stimulus. While we believe that Canadian investors should consider a broad set of return drivers to achieve their long-term objectives, the economic disruption caused by the COVID-19 pandemic illustrates why multiple investment levers can be beneficial when managing portfolios through rapidly changing market conditions.

Target Date Funds are growing in popularity

Within CAPs, TDFs are gaining an increasing share of assets under management and contributions. A recent report from Sun Life Group Retirement Services (GRS), titled Designed for Savings 2019, shows that TDFs have grown from representing 7% of CAP assets in 2010 to 29% at the end of 2018. It also shows that more than 35% of all plan member contributions go to TDFs. This growth is coming largely at the expense of balanced, target-risk and Canadian equity funds, which have all experienced significant declines over the past five years as a percentage of Sun Life GRS’s overall asset mix6.

At the end of 2018, 77% of Canadian CAP sponsors with at least 200 plan members had designated TDFs as their default option for plan members who do not provide investment directions, according to the same Sun Life report6.

Why is it that TDFs appeal to many CAP sponsors? CAP designs vary, but they commonly offer plan members a limited selection of à la carte investment options and some form of diversified, easy-to-use asset allocation investment, such as a TDF. CAP sponsors have recognized that plan members, whether engaged and knowledgeable or not, face many obstacles when building their own portfolios. TDFs can help overcome these obstacles. This table summarizes the potential benefits of choosing TDFs as a default:

| Issue | Fact | Implication |

|---|---|---|

| A. Limited investment opportunity set | Plan sponsors typically do not make non-core, diversifying investment funds available to CAP members on a standalone basis for fear of misuse by inexperienced investors. At the end of 2018, only 5% of CAPs offered standalone options in specialty asset classes (such as listed real estate, listed infrastructure, etc.)7. | CAP members often face a limited investment opportunity set, which may result in lower risk-adjusted returns. |

| B. Investor expertise constraints | According to the Financial Consumer Agency of Canada, many Canadians lack even a basic understanding of financial matters. Based on a survey conducted by the OECD8, only 61% of Canadians (on par with other OECD countries) could correctly answer five of seven very basic financial knowledge questions. |

Canadians tend to have difficulty making sound investment decisions. Poor financial literacy can lead to undue risk aversion or risk-taking. |

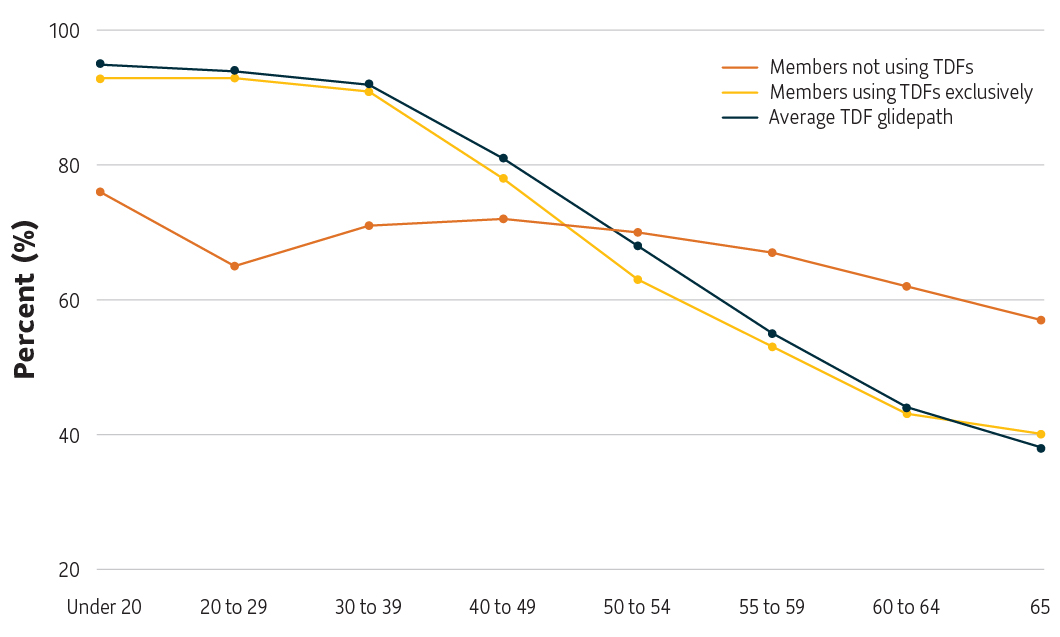

| C. Lack of time and investor engagement | As illustrated in Figure 1, plan members who build their own portfolios have a relatively constant average level of equity exposure despite significant differences in age and investment time horizons.4 | The data suggests plan members are taking a “set-it-and-forget-it” approach to establishing their portfolio's he data asset mix, a difficult decision in the investment process but one that is critical to the long-term success of a portfolio. |

Figure 1: Equity exposure by age group7

Source: Sun Life Group Retirement Services

TDF investors have historically outperformed

There is good reason to be optimistic about the popularity of TDFs. Indeed, data on Sun Life GRS CAP members’ returns has shown that TDFs have helped members to improve their retirement outcomes.

When we compare the average historical return (net of fees) of non-TDF investors with those of TDF investors, we find that TDF investors have outperformed on average by about 1% per year on a five-year basis9.

Figure 2: TDF investors outperform non-TDF investors

| Average 5-year annualized returns (net of fees) | Compounding effect over 5 years | |||

|---|---|---|---|---|

| Investment Strategy | Jan 1, 2010 to Dec. 31, 2014 | Jan 1, 2012 to Dec 31, 2016 | Jan 1, 2014 to Dec. 31, 2018 | Ending balance having invested $57,465* from Jan 1, 2014 to Dec 31, 2018 |

| Average | Average | Average | ||

| Members using TDFs only | 7.8% | 7.9% | 6.0% |  $76 901 $76 901 |

| Members not using TDFs | 6.9% | 6.8% | 5.1% |  $73,691 $73,691 |

| Excess return | 0.9% | 1.1% | 0.9% |  $3,210 $3,210 |

Note: Includes all target date funds offered on the Sun Life GRS Core investment platform, excluding Sun Life Milestone Funds. *Based on Sun Life GRS data, the average account balance for members at the mid stage of their career (cohort aged 35 – 49) as of January 1, 2014, was $57,465.

The 0.9%-1.1% annualized average additional return (net of fees) generated by TDFs over these 5-year periods had positive effects on CAP members’ account balances, especially when compounded over time. The average account balance for members at the mid-stage of their career (cohort aged 35 – 49) as of January 1, 2014, was $57,46510. Investing this amount solely in TDFs over the 2014-2018 period would have, on average, grown a member’s savings by an additional $3,210 compared to non-TDF investors.

More recently, looking at the investment performance of plan members investing through the COVID-19 pandemic (Figure 3) further reinforces the trend of TDF-only investor’s outperformance.

Figure 3: Historical short-term performance differential, TDF vs non-TDF investors

| Average Annualized returns ending April 30, 2020 (net of fees) | |||

|---|---|---|---|

| Investment Strategy | 1 Year (May 1, 2019 to April 30, 2020) |

2 Year (May 1, 2018 to April 30, 2020) |

3 Year (May 1, 2017 to April 30, 2020) |

| Average | Average | Average | |

| Members using TDFs only | -2.26% | 3.35% | 3.32% |

| Members not using TDFs | -4.08% | 1.23% | 1.91% |

| Excess return | 1.82% | 2.12% | 1.41% |

Note: Includes all target date funds offered on the Sun Life GRS Core investment platform, excluding Sun Life Milestone Funds.

It is important to keep in mind, however, that not all TDFs are built and maintained in the same way. Understanding the shifting landscape for TDFs can help CAP sponsors identify the TDF solutions that equip their plan members most effectively to help them navigate their way to and through retirement.

1Willis Towers Watson Global, Pension Assets Study 2019.

2Willis Towers Watson, Global DC Pension Assets Exceed DC Assets for First Time (February 1, 2019).

3Canadian CAP assets derived from Strategic Insight, 2019 Group Retirement Savings and Pensions Report—Canada, and Willis Towers Watson Global, Pension Assets Study 2019.

4Strategic Insight, Q1-2020 Update Group Retirement Savings and Pensions Report—Canada.

5World Economic Forum, We’ll Live to 100 – How Can We Afford It? (2017), Investing in (and for) Our Future (2019).

6Sun Life Group Retirement Services, Designed for Savings 2019 Report.

7Sun Life Group Retirement Services, Designed for Savings 2019 Report.

8Organization for Economic Co-operation and Development (OECD) Survey on Measuring Financial Literacy and Financial Inclusion, 2015.

9Results provided by Sun Life Group Retirement Services.

10Sun Life Group Retirement Services, Designed for Savings 2014 Report.

Information contained in this whitepaper is provided for information purposes only and is not intended to provide specific financial, tax, insurance, investment, legal or accounting advice and should not be relied upon in that regard. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment fund managed or sub-advised by SLGI Asset Management Inc. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

Information herein has been compiled from sources believed to be reliable as of the date of publication, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

This whitepaper may contain forward-looking statements about the economy, and markets; their future performance, strategies or prospects. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon. Forward-looking statements involve inherent risks and uncertainties about general economic factors, so it is possible that predictions, forecasts, projections and other forward-looking statements will not be achieved. You are cautioned to not place undue reliance on these statements as a number of important factors could cause actual events or results to differ materially from those

expressed or implied in any forward-looking statement. Before making any investment decisions, you are encouraged consider these and other factors carefully. The indicated rates of return are shown before the deduction of fees. Mutual and segregated fund values change frequently and past performance may not be repeated.

Group Retirement Services are provided by Sun Life Assurance Company of Canada. Sun Life Granite Target Date Funds are segregated funds of Sun Life Assurance Company of Canada, managed on a sub-advisory basis by SLGI Asset Management Inc. Sun Life Granite Target Risk segregated funds launched November 2009 and were managed on behalf of GRS by Sun Life Assurance Company of Canada. In 2012, Sun Life Global Investments (Canada) Inc. launched Sun Life Target Risk mutual funds, at which time the Sun Life Granite Target Risk segregated funds were closed and new funds were created that invest in mutual funds with a similar mandate to each of those funds.

Sun Life Assurance Company of Canada and its affiliated companies respectively own or properly license all the trade-marks used on or in connection with the goods and services which they provide. The trade-marks are protected by Canadian and foreign trade-mark laws. All rights reserved. Sun Life Granite Target Date Funds, Sun Life Granite Multi-Risk Target Date Funds and Sun Life Granite Target Risk Funds are segregated funds of Sun Life Assurance Company of Canada, managed on a sub-advisory basis by SLGI Asset Management Inc.

© SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and their licensors, 2021. SLGI Asset Management Inc. and Sun Life Assurance Company of Canada are members of the Sun Life group of companies. All rights reserved.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.